How to Invest and Do Good for the Planet

A conversation with Andrew Behar, author of "The Shareholder Action Guide"

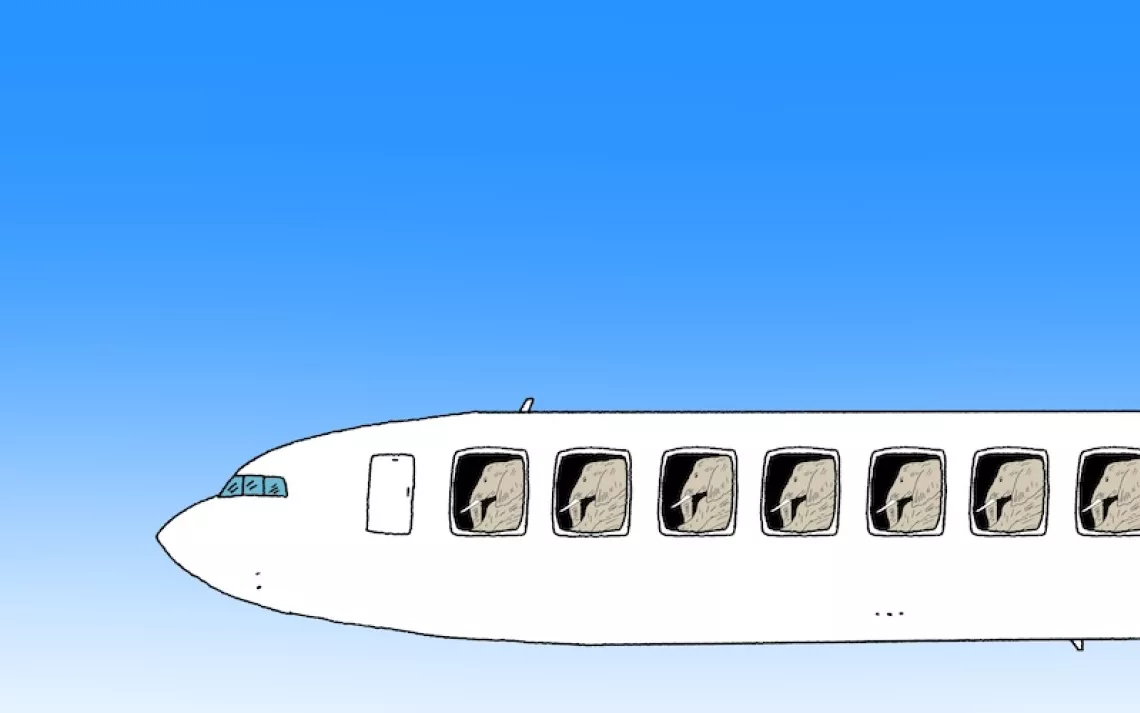

Photo by tuk69tuk/iStock

Andrew Behar is motivating America’s largest corporations to be profitable and more environmentally sustainable. He’s encouraging others to join him in this mission. Behar recently authored The Shareholder Action Guide, a book that shows how stockholders, mutual funds owners, and retirement plan participants can transform corporate behavior through shareholder advocacy.

Behar can already identify a growing army of investors who are influencing unprecedented actions at corporations, including Walt Disney Companies, Abbott Laboratories, and McDonald’s. Each day, he enlists more to hold corporations accountable to shareholders’ interests.

Behar is chief executive officer of As You Sow, a nonprofit dedicated to promoting environmental and social corporate responsibility through advocacy, coalition building, and innovative legal strategies. Sierra recently spoke with Behar about his new book.

—Patrick Fitzgerald

0 0 1 2 Sierra Club 1 1 2 14.0Normal 0 false false false EN-US JA X-NONE

/* Style Definitions */ table.MsoNormalTable {mso-style-name:"Table Normal"; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-priority:99; mso-style-parent:""; mso-padding-alt:0in 5.4pt 0in 5.4pt; mso-para-margin:0in; mso-para-margin-bottom:.0001pt; mso-pagination:widow-orphan; font-size:12.0pt; font-family:"Times New Roman";}

♦

Why did you write The Shareholder Action Guide?

I wanted to tell people they have so much power—more than they ever could imagine. People mostly abdicate that power because they’re just not aware of it. The vast majority of our money is tied up in our retirement plans. Yet, few of us know our investments. My hope in writing this book is to awaken a movement of shareholders, of individual investors who are willing to use their investment power to effect change in corporate behavior. We are talking about trillions and trillions of dollars here—it’s a huge amount of power if it were to be unleashed.

Who are these shareholders? Are you talking about individual stockholders, people invested in mutual funds, or individuals who participate in their company retirement plans?

All of the above: anyone who owns an equity share, a mutual fund through a 401(k) or 403(b) retirement plan, and contributes to a pension fund. There are many ways for people to save for the future and align their savings with their values. If, as investors, they want to shape their future and their children’s future, they can do it right now if people exercise their investment power.

In the book, you say the world is out of balance. How is it out of balance?

Corporations are the most powerful entities on the planet. They run governments and are just so ubiquitous. Corporations are owned by shareholders. If you invited all of Exxon’s shareholders to a football stadium, I think you’d find out two things: One, most people would be shocked to be invited to the stadium. Most people don’t know they own Exxon. Two, when asked, those shareholders would say, “No, this company does not profess the values I believe in.”

Just in terms of common sense, our current situation does not make sense. It has to do with how power plays out in our economy. As an example, the petroleum and chemical industries, through their trade associations, have the ability to warp our rulemaking and lawmaking abilities to such an extent as to allow our well-being, our health, our communities, and our children to be threatened.

We all are a part of it. We are all profiting from these exercises of power, and we don’t realize it. It’s time to really exert our shareholder power and say, “No, this is not the world we want to live in.” We are responsible for it. It is not somebody else’s responsibility.

We hear an orthodoxy about the power of a free, deregulated marketplace to resolve all issues. Will the marketplace alone help corporations use their power wisely? Are corporate interests aligned with society’s best interests?

I think we are beginning to see that happen now. This new administration is actually motivating people. You see websites like Grab Your Wallet where people are saying, “I don’t want to spend my money here.” That’s a powerful message, and you can see these companies responding really, really rapidly to it. People are saying, “Whoa, I guess I do have some power here.” That’s a really simple example of it.

It is time for investors to just wake up and accept their ownership and actually do the research necessary to understand what they own. Look inside, see what you’re invested in, check in with your values, and then make decisions accordingly.

Efficient markets are about transparency. I believe that markets are incredibly powerful when there is transparency. We’re seeing this flow of money into companies that have responsible environmental, social, and governance (or ESG) policies. It is a myth that investors are not going to make as much money if they invest in companies with good ESG policies.

[Socially responsible] investments have doubled from $4 trillion to $8 trillion from 2014 to 2016 alone. That amounts to 20 percent of all investments in the United States. The movement is happening. People are wising up.

What do you mean by “shareholder advocacy,” and how is this different from “shareholder activism?” What is required in order to become a shareholder advocate?

People have heard about shareholder activists. That is a term that was specifically substituted for the term “corporate raiders.” Corporate raiders were famous for corporate takeovers through proxy voting. Corporate raiders would strip all the money out of the company, distribute a predetermined amount to the shareholders, and keep the rest of the money for themselves. They put employees out of work and just left a shell of a company.

On the other hand, shareholder advocates use the exact same tools like proxy votes and shareholder resolutions, but their intention is to make the company better. Their goal is to make the company sustainable in the long term. The companies respond to this advocacy because they see the logic in it. It is just good business.

How does your book empower individuals and groups to take action? How does shareholder advocacy work?

If you own one share of a company stock, you can vote your proxy; you can attend the annual shareholder meeting at which you can speak publicly to the chief executive officer and the governing board. If you own $2,000 of company stock for one year, you can file a shareholder resolution, which is a 500-word document expressing your idea to the company. The more other shareholders support your resolution—and it doesn’t take a lot—the more the company’s governing board pays attention to what you have to say. You’ll have several chances to enlist shareholder support. However, the resolutions cannot be about “ordinary” business, such as suggesting a new menu choice like chocolate-covered french fries.

But you can say, “Here’s how you can be a better company.”

If you own a mutual fund, you can look inside. If you don’t like the investments you see, you can sell it and buy one you like. If you’re in a retirement plan at work, and you don’t see any suitable funds to invest in, you can go to your plan administrator and say, “Hey, there’s nothing here I can invest in, can you help me out? Here are fund alternatives to add that meet ESG standards.” The plan administrators must evaluate your request. You may need to be persistent, but it’s not a big deal for them to add another fund to your 401(k) plan.

Can you point to specific changes in corporate behavior because of shareholder advocacy efforts?

Home Depot is a great story. Rainforest Action Network did all this incredible work with other shareholder advocates to end the use of wood products from endangered forests.

Some recent actions involve antibiotics in meat. Wendy’s and Burger King just made a big shift to phase out the use of antibiotics in meat production. Other advocacy groups have filed similar resolutions with McDonald’s

Green Century Funds has done amazing work with the production of palm oil and deforestation. Shareholder advocates are holding companies accountable for their use of palm oil.

Do shareholders have a moral obligation to act?

Is it a moral obligation, or is it the self-interest of reducing risk in your portfolio? Many companies are making changes because they want longevity and to make money. I think a lot of shareholders are doing this research out of self-interest. They want their investment to do better. Even the oil industry must be responsible to their shareholders. At our organization, As You Sow, we see divestment as the final step in the engagement process.

In terms of the question of morality versus sustainability, I think there is a blend there. We are living in a very interesting time right now. We are at this pivot point where the forces that are trying to hold on are on their way out. They are desperately kicking and screaming. This is the moment for those of us who are working toward sustainability to really get motivated and organized. If everyone became aware of what’s in their retirement plan and led with their values, it could be an incredibly powerful thing.

The Magazine of The Sierra Club

The Magazine of The Sierra Club