Electricity customers in the mid-Atlantic and Ohio Valley regions can breathe a sigh of relief after an anti-clean energy rule that threatened to saddle customers with $1.7 billion in additional costs each year met a quiet demise. This victory is the result of years of work by consumer and environmental advocates, as well as clean energy leaders on the state level, to reverse a rule that threatened to undermine state clean energy policies at the behest of fossil fuel interests, which wield excessive influence in the decision-making processes of the obscure organizations that operate wholesale electricity markets in much of the country.

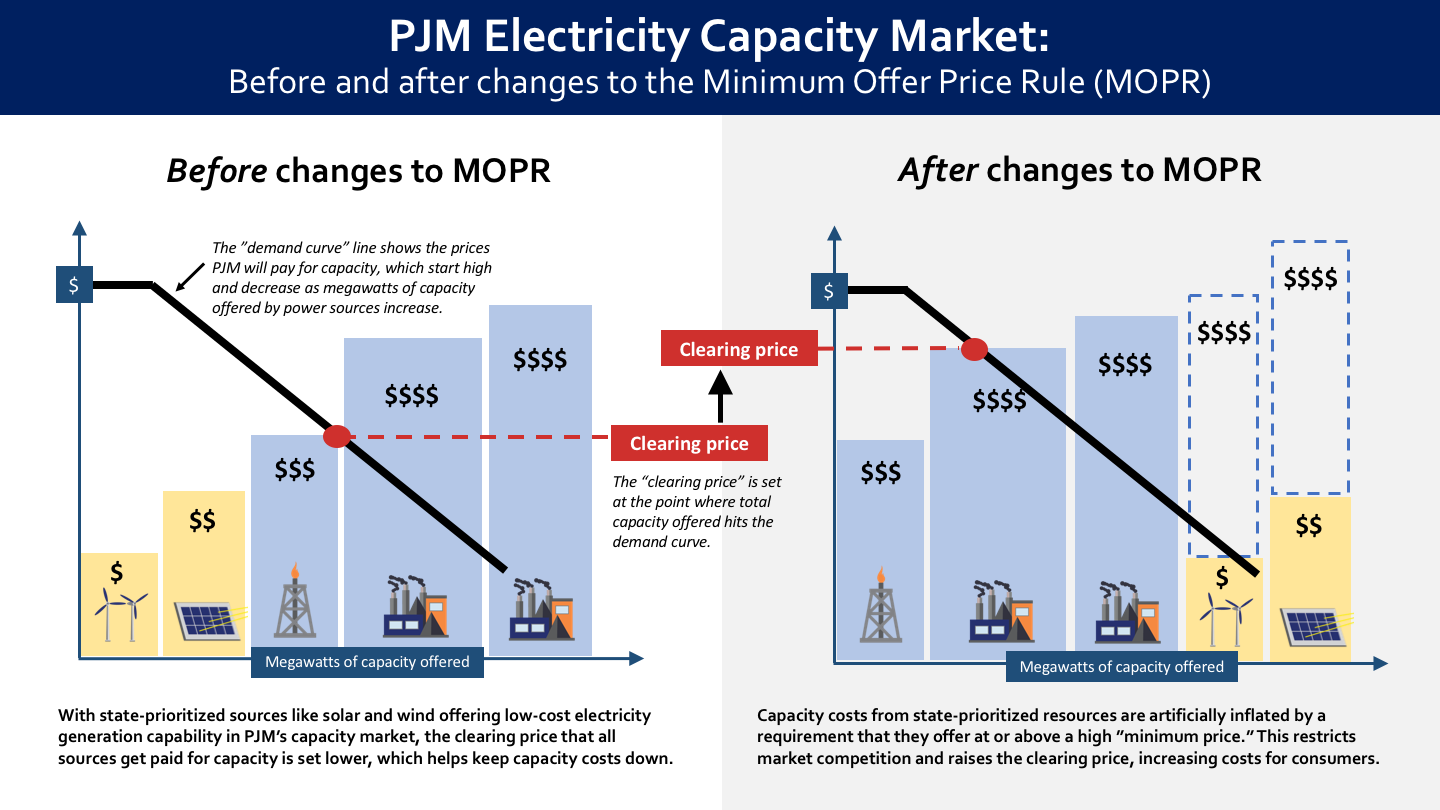

Over 65 million customers get their electricity from a grid operated by PJM Interconnection, LLC. PJM is a regional transmission organization that operates the transmission system in the 13-state region, and runs electricity markets that determine who generates electricity, and how much they get paid. One of those markets procures “capacity,” or the commitment to be available to generate electricity during some time period in the future. PJM determines how much capacity it needs to meet a forecasted peak demand plus a comfortable margin for error, and capacity suppliers—generators and demand response resources—submit their offers to meet that demand. The lowest cost offers needed to meet demand are selected to receive capacity obligations, and the most expensive of the offers selected sets the price that all of these suppliers will receive. (See my prior blog for more detail on how the capacity market works).

The capacity market, which now costs PJM consumers as much as $10 billion annually, was instituted nearly 15 years ago in order to provide an additional price signal to support investment in generation resources. The basic concept behind the capacity market is to supply the “missing money”—the difference between the revenue a generator needs to enter or stay in business, and the revenue it expects to earn from making and selling electricity on a day-to-day basis. The bigger that difference, the higher the supplier’s capacity market offer must be.

Most renewable energy facilities make money not only from selling electricity, but also from selling the environmental attributes of that electricity, often referred to as “renewable energy credits” or RECs. Sometimes these RECs are sold to companies or government entities with green power procurement goals, but most of the demand for RECs comes from utilities seeking to show compliance with state renewable portfolio standards. Because of this additional revenue stream, renewable energy producers can offer their capacity at a lower price (they have a lower “missing money” value). As a result, they have been able to edge more expensive or less efficient generation resources out of the capacity market, and have lowered prices for consumers in the process.

Investors in generation resources most likely to be edged out of the market—often inefficient fossil fuel generators—have argued that the resulting capacity market prices are too low to support the investment in new generation the region needs. For years these investors have waged a campaign in the PJM stakeholder process and at the Federal Energy Regulatory Commission (FERC), which regulates PJM’s markets, to counter the effects of state policies and increase prices. PJM itself—ostensibly an independent entity—had come to agree with this perspective and urged FERC to “protect the market.”

In 2019, FERC issued an unprecedented order agreeing with these arguments, and requiring all generators that received even an iota of revenue as a result of state policies to sell their capacity at an administratively determined price that is far higher than they would otherwise have offered and that ignores the revenues they are already earning from the sale of RECs. FERC established this policy through an expansion of the “minimum offer price rule,” or MOPR, which previously had only applied to make sure that energy buyers did not submit artificially low offers in an effort to suppress the price. The new, expanded MOPR would increase capacity prices and make it far less likely that state-supported clean energy resources would “clear” in the capacity market instead of fossil fuel plants. The result would be that fossil fuel plants would continue to sell unneeded capacity, while wind and solar resources would not receive any of the $10 billion paid by PJM customers annually despite providing both capacity and environmental benefits to the grid.

States with aggressive decarbonization targets did not take the matter lightly. Besides filing lawsuits, policymakers from Maryland, New Jersey, and Illinois began to explore the option of having their utilities opt out of the capacity market through a previously obscure mechanism known as the “Fixed Resource Requirement.” Even PJM itself sought rehearing of FERC’s order, which went far beyond the scope of what PJM itself had proposed, on the basis that FERC’s order failed entirely to accommodate legitimate state policies.

Fast forward to early 2021; PJM has a new CEO, and the FERC commissioner who had loudly dissented from the 2019 MOPR order is now the FERC chair. An enormous utility in PJM’s service territory—Dominion Energy Virginia—has exited the capacity market, citing the adverse impacts of MOPR. In this milieu, PJM kicked off an accelerated stakeholder process to develop revised MOPR rules in time for the next capacity auction scheduled for December 2021. But instead of aligning itself with suppliers who wanted to increase capacity prices and undermine state policies, PJM took a different position this time around. PJM concluded that state policies to advance decarbonization are not a threat to resource adequacy, but instead support it. PJM also acknowledged—as the Sierra Club and other consumer advocates had been saying for years—that rather than sending the correct price signal, the expanded MOPR would actually inflate capacity prices far above the level needed to attract investment in the region. PJM’s proposal would significantly curtail the scope of the MOPR--instead of being used to nullify the effects of state policies, it would go back to its original purpose of preventing market manipulation. A vote of PJM members showed overwhelming support for PJM’s proposal compared to nearly a dozen other proposals, many of which made only cosmetic changes to the expanded MOPR. PJM filed its proposed changes at FERC in late July, and in late September, PJM’s filing automatically went into effect when FERC’s four commissioners were evenly divided for and against the filing.

Gas developers are almost certain to challenge this latest development in court, as many of them rely heavily upon capacity market revenues to provide returns for their investors. The day after PJM’s new rules went into effect, a 1,000 MW gas plant under development in Pennsylvania finally threw in the towel. This announcement comes on the heels of over 3,600 MW of coal retirements in PJM states announced this past summer in the wake of unusually low capacity market prices. The Sierra Club has been engaged since the expanded MOPR was proposed, helping to build coalitions and galvanize opposition to the expanded MOPR, while assembling evidence to demonstrate to FERC that this rule did nothing but harm consumers in order to benefit an exclusive group of fossil-fuel investors. Fossil fuel generators’ efforts to use the capacity market as a roadblock to a cleaner grid have been rebuffed in favor of a market design that allows states to accelerate the transition to a more affordable, less polluting electricity mix.