Can Farmington, New Mexico, Survive Without Fossil Fuels?

A town seeks to reinvent itself after its economic engine collapses

Photos by Minesh Bacrania

A FEW YEARS AGO, the American Amateur Baseball Congress formed a collegiate league team in Farmington, a city of 45,000 in the high desert of northwestern New Mexico. Management named the team the Frackers in homage to the combination of horizontal drilling and hydraulic fracturing that had revolutionized the US energy industry.

On the surface, the moniker seemed like a natural fit. Oil and gas companies have been drilling in the area for a century. The landscape in the surrounding San Juan Basin, the economy, and even the town’s identity are inextricably entwined with fossil fuels. Smokestacks from two massive coal plants west of town dominate the horizon. A cluster of gas wells cozy up next to one of the town’s ball fields.

Wendy Atcitty, the New Mexico energy organizer for Diné CARE, in front of the For the People mural, painted by artist Ivan Lee for Farmington’s Art in the Alley project

Yet even some local oil and gas industry leaders found the team’s name to be a bit tone-deaf, given that the region’s fossil fuel economy was in steep decline. The uptick in fracking in 2005 had caused the price of natural gas to slump, and recently, city officials had kicked off a rebranding campaign called Jolt Your Journey, which endeavored to de-emphasize the area’s reputation as an industrial hub and instead highlight the landscape, culture, and archaeology as well as the climate and other quality-of-life amenities.

The uneasiness over the baseball team’s name reflected a larger tension in Farmington, where the impulse to cling to the fossil-fuel-centered past pushes up against the desire to embrace a more diversified economy. This tension is most evident in the multipronged effort to keep the town alive, even as the major drivers of its economy lie in tatters. The local natural gas industry appears to be in a permanent bust, the two huge coal-burning power plants outside town are slated to close, and the impacts of the novel coronavirus have exacerbated unemployment.

As Farmington works to reinvent itself, it’s unclear which vision will prevail—whether the town will move toward a more equitable and sustainable model of economic prosperity, hold on to its fossil-fuel-dominated past, or stumble into some messy version of the two.

NORMAN NORVELLE'S FAMILY rolled into Farmington in 1957, when he was just 10, their belongings loaded into a 1953 Chevrolet sedan. “It was a beautiful place,” Norvelle said of the area, known as Totah, or “between the waters,” to the Navajo. “There were orchards and truck gardens everywhere.” The air was so clear then that on weekends, when the Norvelles piled into the car and drove into the La Plata Mountains, just over the Colorado state line, Norman could see all the way across the San Juan Basin to the Sandia Mountains, some 200 miles away.

The region was undergoing a radical transformation at the time. In 1951, El Paso Natural Gas completed a major pipeline that ran from Farmington to the California border and then branched out to that state’s growing metro areas. Farmington’s population exploded as workers—including Norvelle’s father, a diesel mechanic and road builder—flooded in. Over the ensuing years, young Norvelle watched the well pads, processing plants, gathering systems, and trailer parks invade, displacing the orchards and agrarian culture.

In order to meet a rising demand for energy, in the late 1950s a consortium of utilities came up with a plan to construct six massive coal-fired power plants and accompanying mines across the Colorado Plateau; the plants would ship power hundreds of miles to rapidly growing southwestern cities. The flagship of this Big Buildup, a term coined by Western scholar and author Charles Wilkinson, was the Four Corners Power Plant and the adjacent Navajo Mine, built about 15 miles west of Farmington on the edge of the Navajo Nation. Albert Reeves, vice president of the company that owned the mine, characterized the project as making good use of a “harsh and unproductive landscape.” Just as the construction cast aside Navajo families who had lived on that land for generations, Reeves’s assessment discounted the Indigenous history and culture that had played out on the landscape for millennia.

Downtown Farmington theater

When, several years later, the San Juan Generating Station and its accompanying mine were built eight miles north of the Four Corners plant, just outside the Navajo Nation, the region’s fossil fuel trifecta was complete, with the steady foundation of coal propping up the more lucrative but volatile oil and gas. The plants generated millions of dollars of tax revenue for the region, and the Four Corners plant and Navajo Mine paid much-needed, if meager, royalties and lease payments to the Navajo Nation. High-paying jobs with benefits helped build up Farmington’s middle class. Norvelle would go on to work in the energy industry for years—at a refinery, a natural gas company, and both the San Juan Generating Station and the Four Corners Power Plant.

But along with the prosperity came pollution. The 200-mile view that Norvelle enjoyed as a kid disappeared behind a curtain of smog. The towering smokestacks spewed thousands of tons of harmful particulates, including the potent neurotoxin mercury, into nearby, predominantly Navajo communities. In 1971, Peter Montague, a prominent environmental activist, testified to a Senate committee that the Four Corners Power Plant was “the greatest single public health hazard in the Southwest and perhaps in the nation—possibly even in the world.” While on the job at the power plant, Norvelle watched as nasty waste products like sodium sulfite and sodium nitrite were dumped into unlined pits and made their way into the Shumway Arroyo, contaminating drinking water downstream.

Farmington and the surrounding communities had, willingly or not, entered into a big trade-off: They gave up clean air and water and even their health in exchange for economic prosperity, commercial development, and the associated amenities—big-box stores, chain restaurants, decent schools, and government services.

The burdens and benefits of this trade-off have not been distributed equally. For every sprawling McMansion with an emerald-green lawn and a household income above $200,000, another 10 households sit below the poverty line, many of them in the shadow of the power plants or next to oil and gas facilities. Farmington’s violent-crime rate has long been at least twice the national average. Last year—during the biggest oil boom the state had ever seen—New Mexico was ranked dead last in child well-being by the Annie E. Casey Foundation.

Wendy Atcitty, who grew up south of Farmington, is well acquainted with the trade-offs and the inequities of the fossil fuel bargain. Her father made a modest living working in the plants—he would come home each night covered in a fine dusting of coal ash. Now the New Mexico energy organizer for Diné CARE, an activist group that has been fighting for environmental, public health, and social justice causes since the 1980s, Atcitty remembers lying in the bed of her family’s pickup as it rumbled down reservation roads, following the power lines with her eyes as they undulated across the bright-blue sky. The electrons dancing in those lines would run millions of lights, televisions, and air conditioners in far-off cities, but they zoomed right past Atcitty’s home and those of many of her relatives. Even today, at least 15,000 Navajo homes are without electricity. “As children, we were used to seeing haze sitting around us, blotting out the view of the majestic mountains that mark our tribal cardinal directions,” Atcitty said, “and never understanding that not everyone in our country hauled water and lit up a kerosene lamp to see at night.”

AS LONG AS THE FOSSIL FUEL INDUSTRY was thriving, there was little incentive for Farmington’s political leaders to diversify the economy and make it more equitable and resilient. In the early 2000s, the economy was firing on all cylinders, thanks to spiking natural gas prices and a growing demand for coal power. The two coal plants churned away at full throttle, and a third one, Desert Rock, was in the works. The industry seemed impervious to recessions, tightening regulations, concerns about climate change, and even lawsuits lobbed by environmentalists. “I was caught up in it,” said Arvin Trujillo, who was the executive director of the Navajo Nation Division of Natural Resources during that time and a proponent of Desert Rock. “You would look at it all and say, ‘The plants won’t shut down . . . we’re doing fine. If it’s not broke, why try to fix it?’”

Downtown Farmington and Farmington’s Art in the Alley project

What Trujillo and others didn’t realize was that even then, cracks were opening up in the economy’s foundation. The same high prices that drove the drilling around Farmington had also sparked a frenzy of fracking in other parts of the country, flooding the market with gas and sending its price tumbling.

The resulting crash—exacerbated by the global recession that started in 2008—reverberated through Farmington’s economy. Tax revenues plummeted, the Farmington metro area lost more than 7,000 jobs between October 2008 and January 2010, home values declined, and new construction skidded to a halt. The low price of fracked gas also slowly eroded coal’s power-generating-cost advantage. At the same time, the Obama administration increased the oversight of coal plants’ environmental and public health effects, making the plants more expensive to operate, and the state of California required its utilities to wean themselves from the dirty fuel. The Desert Rock proposal—battered by strong local opposition—unraveled in 2009. Lawsuits by the Sierra Club and other environmental groups as well as divestment by California utilities forced the Four Corners plant to install costly pollution-control equipment and close units in 2013, and the San Juan plant to do the same in 2016 and 2017, respectively, resulting in markedly improved air quality, according to EPA data, but also a loss of jobs and tax revenue.

Farmington’s economy never recovered from these setbacks, despite the oil production boom taking place in the Permian Basin, on the other side of the state (see “A Long Sunset”). Even before the current pandemic-induced recession, the unemployment rate chronically lingered above the national rate, and today Farmington is one of the only metro areas in the West with a shrinking population. Companies that once dominated the economic landscape there—ConocoPhillips, BHP, WPX Energy, BP—have sold out and fled, taking high-level management jobs and their salaries with them. Westmoreland Mining, which owns the San Juan Mine, went into bankruptcy last year, imperiling miners’ pensions and benefits but forking out bonuses and retention pay to management. “We’re a community that’s often abandoned,” said longtime Farmington resident Mike Eisenfeld, the energy and climate program manager of the environmental group San Juan Citizens Alliance. “Once the resource runs out, or is no longer profitable, they just up and leave.”

Area surrounding Farmington

Last spring, as measures to stem the spread of COVID-19 shut down all but essential businesses, the Farmington economy shed 6,000 more jobs. As elsewhere, the long-term economic effects of the pandemic remain to be seen—much will depend on the kinds of relief programs that Congress offers. Regardless, the fossil fuel industry’s future in Farmington looks bleak.

In 2022, the Public Service Company of New Mexico (PNM) will shut down the San Juan Generating Station because it is no longer economical to run; the Four Corners Power Plant is slated to follow in 2031. “Your foundational economic driver is going down,” said Trujillo, now the CEO of Four Corners Economic Development, a private nonprofit that fosters local business opportunities. “It’s like a spiderweb, with the coal plants in the middle. When all these $80K-to-$100K jobs disappear, what do we do then?”

That’s a question a lot of people are asking themselves about Farmington these days.

One statewide solution is the Energy Transition Act (ETA), signed into law by New Mexico governor Michelle Lujan Grisham last March. It requires the state’s electricity sector to go carbon-free by 2045, something that PNM, the state’s largest utility, had already pledged to do. The ETA does not force the closure of the San Juan Generating Station. Rather, it’s a response to PNM’s economically motivated decision and creates a mechanism for transitioning away from coal by allowing PNM to take out bonds to provide affected communities with up to $70 million for economic development, worker retraining and assistance, and reclamation of the associated coal mine.

“The ETA is a starting point,” Atcitty said, “and gives at least a drop in the bucket for economic development. Without that, the Four Corners region would be like Peabody in Arizona after the Navajo Generating Station shut down—no economic package for workers or affected communities.” The November 2019 closure of that coal plant and associated mine in northern Arizona put more than 800 people out of work and blew huge holes through the Navajo Nation’s and Hopi Tribe’s budgets, tainting what should have been a major environmental victory. “We care what happens to these families,” Eisenfeld said. “It’s not environmentalists against coal miners, and it never has been.”

Atcitty, Eisenfeld, and their colleagues hope that the money from the act, which falls far short of filling the $117-million-per-year hole to be left by the San Juan Generating Station’s departure, will, in addition to helping laid-off workers, seed efforts to ditch fossil fuels and build a cleaner, healthier, more equitable economy.

Those efforts include the push to develop renewable energy. Photosol US, a subsidiary of a French renewable energy company, recently proposed two solar facilities for the area: the Shiprock Solar Project, a 372-megawatt photovoltaic array with battery storage on Bureau of Land Management land near the San Juan Generating Station, and, in partnership with the Navajo Transitional Energy Company, a 200-megawatt array on reclaimed portions of the Navajo Mine. Property taxes on the Shiprock facility would fill the void that will be left in the local school district’s budget when the San Juan plant closes, and the NTEC facility would generate revenues for the Navajo Nation. Photosol said that the Shiprock facility will directly employ 500 people—about the same number of workers who will lose jobs when the coal plant and mine shut down—during the two-year construction phase and some 15 to 30 people during operation.

These projects will compete with a bid to keep the San Juan Generating Station running for another decade or more. Enchant Energy, a small firm that exists solely to pursue this agenda, plans to partner with the city of Farmington to install equipment in the aging plant that would capture up to 90 percent of its carbon dioxide emissions. Enchant would then either store the carbon underground or pipe it to the Permian Basin and sell it to oil companies, which would then inject it into depleted wells to coax out more crude, a technique called enhanced oil recovery. Revenue would come not only from power sales but also from federal tax credits for carbon capture, which were recently expanded by Congress. The local miners’ union and Farmington mayor Nate Duckett have come out in strong support of the plan, as it would purportedly actualize the long-standing dream of “clean coal” while keeping existing jobs and tax revenues intact.

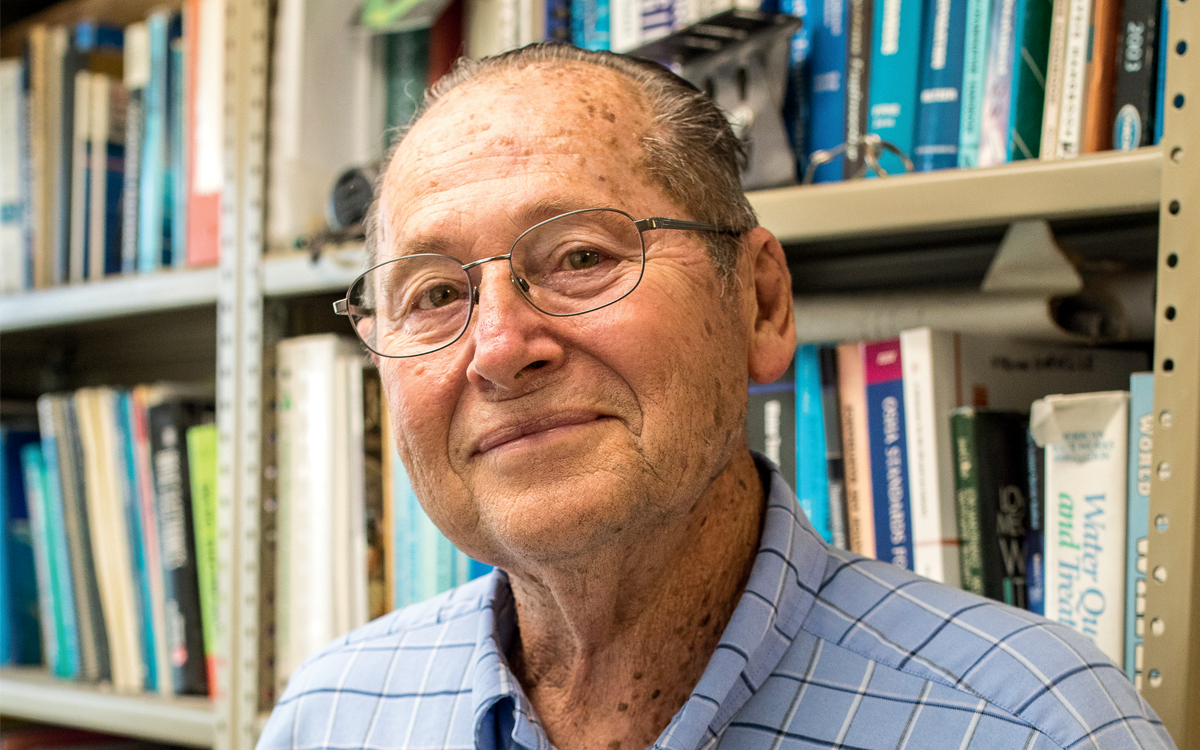

Norman Norvelle in his office at home. He moved to Farmington with his family as a 10-year-old and witnessed its transformation from a quiet agrarian town to a juggernaut of oil, coal, and gas production. Though he was employed by the fossil fuel industry, he became disheartened by the environmental harm it caused.

But critics, including Norvelle and Eisenfeld, say that Enchant’s plan is deeply flawed. The billion-dollar price tag for the retrofit would likely put an already economically shaky plant deeper into the red, and the carbon capture equipment would use a lot of the electricity generated by the plant, leaving less for Enchant to sell—if it could find buyers. In essence, Enchant would be burning coal in order to produce carbon, with electricity as a desirable byproduct. Meanwhile, each year, the plant would continue to suck more than 5 billion gallons of water out of the dwindling San Juan River for cooling and steam generation and kick out over a million tons of coal ash. And the San Juan Mine would still emit tens of thousands of metric tons of methane, a greenhouse gas far more potent than carbon dioxide, all in order to cash in on tax credits and keep the flagging coal industry afloat.

These competing visions for how Farmington can sustain itself are a bit like the ideological tug-of-war between the Jolt Your Journeyers and the Frackers. In some ways, Trujillo, the economic development CEO, embodies both points of view. He met with me last spring, just before the coronavirus began wreaking havoc on the nation, and talked over a desk scattered with papers and periodicals, the most recent copy of Native Business on top. “Our economy has always been focused on energy,” said Trujillo, who grew up in the Nenahnezad chapter of the Navajo Nation, in the shadow of the Four Corners Power Plant. “We need to look in other areas—to diversify our economy and market the quality of life.”

To that end, Trujillo’s organization has supported initiatives such as the Harvest Food Hub, which links farmers up with local restaurants and retail outlets, and the effort to leverage incentives to attract more moviemakers, and maybe a production studio, to that corner of the state. And it has collaborated with the city of Farmington as the city has launched its own economic development office, hiked its sales tax to help fund the development, added recreational amenities to the town reservoir, increased marketing of tourist attractions, and begun giving the historic downtown—which has long been riddled with more payday loan joints than boutique shops and restaurants—a “complete streets” makeover to be less car-centric.

But Trujillo’s background—he worked for the local coal industry for a good part of his career—comes to the fore with two of his pet ideas: He wants to utilize ample stores of natural gas as feedstock in a petrochemical plant and to build a freight railroad spur to town that would help would-be manufacturers get their products to outside markets.

This propensity to fall back on fossil fuels is partly a reflection of how difficult it is to replace mining and drilling jobs and wages on a one-to-one basis. Tourism, retail, and outdoor recreation pay far less than the extraction industry, and local and state governments don’t have tax structures in place to capture as much revenue from the former industries as they do from oil, gas, and coal. The very same qualities that draw tourists tend to cause housing prices to rise, thus widening the gap between the wealthy amenity migrants and the working poor. By throwing just about everything at the wall and seeing what sticks, however, officials risk spreading resources too thin and working at cross-purposes.

Ultimately, economics, not ideology, will determine the direction in which Farmington goes. Fossil fuels have dominated the town’s economy and the energy mix of the world not because they are somehow better, and not because people like Trujillo or Duckett or even the US president are pushing them, but because burning them has been profitable for powerful stakeholders. With renewables getting more affordable, and companies having to pay the real costs of burning fossil fuels, there is less and less money to be made off coal.

Proponents of Farmington’s fossil fuel industry would do well to take note of what happened to the Farmington Frackers. The team played three successful seasons, posting winning records and drawing decent crowds. Nevertheless, at the end of last year’s baseball season, the team’s owner announced that the Frackers would be disbanded. The reason? They ran out of money.

This article appeared in the September/October 2020 edition with the headline "The Big Breakdown."

This article was funded by the Sierra Club's Beyond Coal Campaign.

The Magazine of The Sierra Club

The Magazine of The Sierra Club