Let's Make an Inflation Reduction Act Deal

Uncle Sam is handing out free money for you to electrify your life. Here's how to get your share.

President Joe Biden's ambitious climate goal is to cut US greenhouse gas emissions in half by 2030 via the Inflation Reduction Act, which provided $370 billion to shift the country off dirty fossil fuels. What's the plan? Electrify everything! The electricity grid is rapidly converting from coal and gas to wind, solar, and other renewables, so now the trick is incentivizing consumers to make use of that clean energy in their homes and on the road. Think of the IRA as a thumb on the scales of consumer demand: Henceforth, going green will be not only the right thing to do but also the most economical.

HOW IT'S SUPPOSED TO WORK

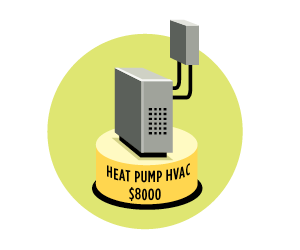

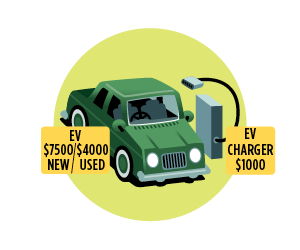

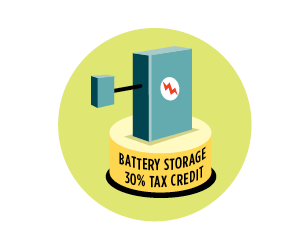

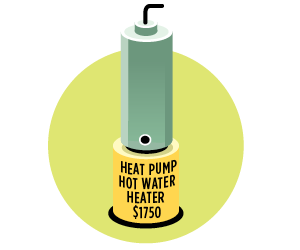

How do you incentivize consumers? Show them the money. The IRA grants generous tax credits and, soon, point-of-sale rebates for home heating and cooling, household appliances, and electric cars. Households can get up to $14,000 to transition to electric appliances: heat pumps, heat-pump water heaters and clothes dryers, and induction stoves. Those making less than 80 percent of the median income in their area can get up to 100 percent of project costs paid, while middle-income families can get up to 50 percent. There are credits for home-energy audits, weatherization, and new electrical panels and wiring. You can get up to $7,500 for qualifying new electric vehicles. If you're installing residential solar, wind, or battery-storage systems, you can get a 30 percent tax credit.

WHAT COULD GO WRONG?

Sure, the IRA is a game-changing piece of climate legislation, but it's also a program of the federal government. While generous, the IRA's benefits are rather complex, and accessing them requires advance planning. Luckily, Rewiring America offers an excellent Go Electric! guide (bit.ly/ira-go-electric).

The main problem at present is that current IRA benefits are chiefly in the form of tax credits. Say you have a $5,000 tax bill but bought a $2,000 heat pump; now you owe only $3,000. That's great, but only if you owe a lot of taxes. If your tax bill is too small, you're out of luck. But don't give up! Possibly starting in late 2023, and certainly in 2024, households earning up to 150 percent of the area average income will be eligible for a whole raft of major rebates on electric appliances and vehicles, available when you make a purchase. These discounts will go on for many years. It takes a long time to run through $370 billion.

THE UPSHOT

It's too bad the free money isn't available for everyone everywhere all at once, but saying sayonara to fossil fuels requires a bit of planning, even with a hefty subsidy. You'll need to figure out which credits and rebates you're eligible for, research qualified contractors, and solicit bids. If you live in an older home, you may have to get it rewired and weatherized—there's IRA money for that too. With this major new federal program, there is no reason not to electrify your life and cool your planet.

The Magazine of The Sierra Club

The Magazine of The Sierra Club