The Environment Is Also on the November Ballot

Voters in many states will be deciding on environment-related initiatives. Here’s our exhaustive guide.

Phobo by iStock | Slavko Serena

This year, the midterm elections are bristling with state initiatives that will have major environmental implications for the entire country.

Ballot measures are an artifact of the Progressive Era, when people turned to direct democracy in the hopes of counteracting the power that corporations like railroads had over local and state politicians (attempts to create a national ballot measure system were tried as well but never got off the ground).

In some ways, ballot measures lived up to their promise. In other ways, they’ve proved to be a hot mess. Scrappy, grassroots organizations can go forth and gather enough signatures to get a policy on the ballot, but so can any person, corporation, or trade organization wealthy enough to hire paid signature gatherers. Once bad legislation has been voted into law by the will of the people, often the only way to change it is via another ballot measure.

Here’s our state-by-state guide to what’s at stake.

Fishing boat in Alaska. | Photo by Jen Taylor/iStock

Alaska

Measure 1

Since the 1980s, various mining companies (most recently a Canadian company named Northern Dynasty Minerals) have been trying to create the Pebble Mine, a nearly 4,000-acre open-pit gold and copper mine in the headwaters of Bristol Bay, home to one of the world’s most productive salmon runs. This year, the state’s total commercial sockeye catch was 60 million. Of that, 39 million came from Bristol Bay.

It’s possible that Alaska’s Fish and Game department could grant a permit to Pebble Mine and other mining projects angling for approval, like the Donlin Gold Mine. The only standard on the books for denying a permit is if plans for the proposed project “are insufficient for the proper protection of fish and game”; and the definition of “proper protection” is wide enough to be interpreted very differently depending on who is in office.

Measure 1—which was placed on the ballot by Alaska Stands for Salmon, a group of scientists, tribal representatives, and conservationists—would replace the “proper protection” standard with a more scientific one that looks at data like water quality and temperature. It would also require the state to take public comment on any permits that would have a major impact on salmon.

Opponents of Measure 1, an outfit called “Stand for Alaska,” portray the measure as an assault on property rights and the political maneuverings of “outsiders.” It’s worth mentioning, however, that the Vote No campaign is one of the best-funded in the state’s history, pulling down at least a million dollars each from several international energy conglomerates as well as BP, ConocoPhillips and ExxonMobil.

Arizona

Proposition 127

According to the U.S. Department of Energy, Arizona has more potential to become a solar energy powerhouse than nearly any state in the Union. Yet the state’s current renewable portfolio standard (RPS) requires Arizona utilities to get 15 percent of their power from renewables by 2025, far below neighboring states.

Arizona’s utility regulators have been dragging their feet about increasing that goal. Even though the state only got 6 percent of its electricity from solar in 2017, and renewable energy is wildly popular with voters regardless of political affiliation, Arizona’s utilities continue to plan for more natural gas plants.

Proposition 127 would increase the state’s RPS each year, with a goal of reaching 50 percent renewable energy in 2030. Proponents say adding more solar to the grid would make Arizona a market for companies like Apple, which seek out renewable energy to power their data centers.

But perverse incentives built into Arizona’s utility regulations mean that building a new natural gas plant returns more profits to shareholders than a new solar installation. This could be why Arizona Public Service (APS), the state’s largest utility, has spent more than $22 million campaigning against Prop 127, on the grounds that it could usher coal plants into early retirement (true), that it would raise utility bills to stratospheric levels (only if regulators let utilities do so), and that it’s a plan backed by Tom Steyer, a California billionaire on a crusade against climate change (true—Steyer has spent $17 million campaigning for Prop 127).

In Arizona’s voter guide, 33 of the 52 arguments in support of Prop 127 were paid for by Clean Energy for a Healthy Arizona, financed by Steyer. Ninety-one of the 133 arguments against the measure were paid for by a committee financed by Pinnacle West Capital Corp., parent company of APS. Together, this battle between big utility and big billionaire has already made Prop 127 the most expensive ballot measure in Arizona history.

California

Proposition 3

Proposition 3 would authorize the state of California to sell $8.9 billion in bonds to pay for water projects and natural habitat restoration. Its proponents—mostly dairies, fruit, nut, and rice farming operations, and duck hunting groups—point to the $2.49 billion that will be paid out to restore watersheds in the Sierra Nevada, San Francisco Bay, LA River, and Salton Sea as an argument in favor of the water bond.

But many Californians aren’t buying it and say that it looks like a “pay-to-play” operation, in which most of the benefits go directly to interests that agreed to support it. Unlike prior bonds, the measure will allow state agencies to spend the bond money without having to prove what benefits those projects are actually providing to the state.

Specifically, Prop 3 opponents point to the $750 million that will go to repair the Friant-Kern and Madera Canals, which irrigate farms in the San Joaquin Valley but are collapsing after years of farmers over-pumping groundwater from the area. Unchecked agribusiness broke the canals, say Prop 3’s critics, so unchecked agribusiness should pay to fix them.

California voters passed two major water bonds not long ago—$4.1 billion in June (Prop 68) and $7.5 billion four years ago (Prop 1). So, despite the state’s water anxieties, it may not be ready for another one.

Proposition 10

Proposition 10 would repeal the Costa Hawkins Rental Housing Act, a state law passed in 1995 that limits how California cities can apply their rent control policies.

In a state with better public transit, this might not have much of an environmental effect. But in California, where residents have some of the worst commute times in the country, Prop 10 could help mitigate the way that rising rents are pushing lower-income residents into cheaper but far-flung suburbs, away from the jobs, public transit, and social services available in urban areas. A report by the Pew Charitable Trust found that the number of Californians who commute more than 90 minutes each way to work grew by 40 percent between 2010 and 2015, with the ability to walk, bike or take transit increasingly becoming a privilege, rather than a choice available to anyone.

Funders of No on 10 are mostly real estate and development firms, which have spent $45.5 million total. Over one-tenth of that comes from the Blackstone Group, a New York–based hedge fund that bought large numbers of foreclosed homes during the financial crisis and is now the largest owner of single-family homes in the country.

Proposition 6

Last year, California lawmakers passed the first increase in state gas taxes in 23 years, from 18 cents to 30 cents a gallon, in the hopes of filling in a $130 billion backlog of highway, road, and transit projects. The gas tax is expected to raise $5 billion a year for the state’s crumbling infrastructure—including mass transit.

Prop 6 would reverse that gas tax and make it nearly impossible for the legislature to pass another one, by requiring a majority of voters to approve any future gas taxes.

Opponents of Prop 6 say that paying an extra $1 to $1.50 each time you fill up your tank is not that much considering the money saved on shocks, tires, and other car repairs caused by deteriorating roads—and that the increased funding for transit is essential to help ease congestion on the state’s clogged highways.

Proponents of Prop 6 argue that California should figure out some other way to pay for transportation infrastructure. Because outrage over taxes is seen as a reliable get-out-the-vote mechanism for conservative voters, some of Prop 6’s biggest boosters are actually out-of-state House Republicans like Paul Ryan, who are hoping that Californians who lean conservative will show up at the polls to vote down the gas tax, and then stick around to vote for House Republicans.

Proposition 12

A decade ago, California residents voted overwhelmingly for Proposition 2, which sought to free the state’s millions of egg-laying hens from cages so tiny that the birds could not stand up, spread their wings, or turn around, while also liberating the state’s pigs and veal calves from similar confinement. Later, the California legislature passed a law mandating that any out-of-state farmers hoping to sell their eggs in California needed to follow the same rules.

This ballot measure resulted in . . . slightly larger cages. So this year, there’s a new ballot measure, with more specific descriptions of what constitutes a minimum welfare standard: one square foot of floor space per hen; 43 square feet for veal calves; and all poultry operations mandated to go cage-free by 2022 (this doesn’t necessarily mean they’ll be able to go outside—they’ll just be in a barn or a coop instead of a cage).

Farm groups spent $9 million trying to defeat Prop 2, but this year they are spending very little—possibly because this time, the new rules will apply to out-of-state poultry farms as well as California ones. Most animal welfare organizations are on board, with the exception of PETA, which argues that Prop 12 doesn’t go far enough.

Colorado

Proposition 112

In 2016, Colorado’s Supreme Court ruled that it was unconstitutional for cities and counties in Colorado to ban fracking—only the state could do that. Proposition 112 is an attempt by residents to take some control over how and where fracking happens.

While it wouldn’t affect pre-existing wells, Prop 112 would increase the minimum distance that new oil and gas wells have to be from homes, schools, parks, and other environmentally critical spots like municipal water supplies to 2,500 feet. That’s the distance public health advocates say is necessary for diffusing exposure to dangerous fumes like benzene that offgas during the fracking process. Currently, the minimum is 500 feet from homes (about one block away), 350 feet from playgrounds, and 1,000 from schools and hospitals.

Opponents of Prop 112 have spent about $16 million fighting the measure, with the largest donations coming from oil and gas companies. They argue that the measure would harm the state’s economy.

Proponents of Prop 112 have spent about $1 million, with the largest donation coming from Food and Water Watch Action Fund. They argue that the jobs and oil money aren’t nearly enough to compensate for the environmental and public health risks.

Amendment 74

Amendment 74 would require that property owners (or mineral rights holders) be compensated for any reduction in property value caused by state laws or regulations. If you are suspecting that this measure was created to troll supporters of Proposition 112, you’d be correct. It’s funded by farmers who are disgruntled at the possibility of not being able to make money off oil and gas leases, and by Protect Colorado, a political action group funded by Anadarko Petroleum, Extraction Oil & Gas and Noble Energy—major oil and gas drillers in Colorado.

But the initiative’s opponents (and some former supporters) argue the amendment is so vaguely written that it’s a legislative disaster waiting to happen.

“The proposal sounds more American than standing for the flag,” wrote the editorial board of the Colorado Springs Gazette in an op-ed reversing its initial endorsement for Amendment 74. “Unfortunately, Amendment 74 is so broad-based it threatens to jeopardize property rights and bilk local governments and taxpayers out of billions of dollars with frivolous lawsuits.”

Connecticut

Amendment 2

Amendment 2 would require the state’s Department of Energy & Environmental Protection and the Department of Agriculture to hold a public hearing and get a two-thirds vote from the General Assembly before selling, converting, swapping, or giving away any state-owned properties like parks, state-owned farms, forests, trails, and wildlife management areas.

Currently, public hearings sometimes happen and sometimes don’t, and transferring ownership of land only requires a simple majority vote. Past land transfers have happened on terms that some Connecticut residents have considered suspicious, like when private developers wound up with a deal to get state-owned land overlooking the Connecticut River in exchange for several acres of forest that were appraised at $1.3 million less than the waterfront land they were getting (that transfer was controversial enough that it never went through).

Amendment 2’s supporters—the Connecticut Forest & Park Association and the League of Women Voters of Connecticut—say that Amendment 2 would give state-owned lands protections comparable to those that already exist in Maine, Massachusetts, and New York.

Very few, if any, people in Connecticut seem opposed to this. State Representative Rick Lopes was quoted in the Connecticut Post as saying that the amendment could “result in many unintended consequences for towns and cities.” But a few months later, his attitude seems to have mellowed. “In the larger scheme of things . . . good job protecting public land," Lopes told news station WTNH.

Deepwater Horizon spill in the Gulf of Mexico. | Photo courtesy of U.S. Department of Defense

Florida

Amendment 9

Amendment 9 would ban both offshore oil and gas drilling in state waters and . . . vaping in indoor workplaces. This unlikely pairing has to do with Florida’s very strange initiative process and the Florida Constitution Revision Commission’s decision to bundle these two together on the ballot. There’s no way for a Florida voter to be pro-vaping at your job while being opposed to being anti-offshore oil and gas drilling—concerned voters will have to compromise.

Supporters of Amendment 9 are largely environmental groups opposed to drilling. Opponents are largely oil and gas companies, vaping trade groups, and libertarians. State law already prohibits drilling in federal waters, and opposition to offshore drilling in Florida stretches across partisan lines. Which has led some people to wonder whether this isn’t just a ploy to assist governor Rick Scott, a Republican, in his bid for a U.S. Senate seat.

Georgia

Amendment 1

Amendment 1 would authorize the state legislature to dedicate up to 80 percent of revenue from the state’s existing sales- and use-tax on outdoor recreation equipment to the Georgia Outdoor Stewardship Trust Fund. The monies would be used to fund land conservation while improving parks and trails. It’s supported by outdoor and conservation organizations and appears to be opposed by absolutely no one, partly because it doesn’t raise any new taxes—just redirects money from existing ones.

Amendment 3

Amendment 3 would change the way that private timberland is assessed so that tax rates are set by the state, instead of individual counties. Both cutters of trees and conservers of trees seem to be on board with this measure.

Montana

Initiative 186

Initiative 186 would give the state’s Department of Environment Quality the ability to deny permits for new hard rock mines (a.k.a. underground mines—usually for gold, silver, iron, copper, zinc, nickel, tin, lead, and sometimes gems) if the project’s plan can’t prove that it will be able to restore area water quality to its former state “without the need for perpetual treatment.”

On the pro side: A committee called YES for Responsible Mining, which has raised $1.16 million. Its largest donor is the pro-fishing nonprofit Trout Unlimited. On the anti side: Stop I-186 to Protect Miners and Jobs, which has raised $2.13 million and is almost entirely funded by the Montana Mining Association.

“Montanans have already paid tens of millions to reclaim and treat polluted water from just a handful of mines,” wrote the editorial board of the Missoulian in its endorsement of 186. Meanwhile, the Montana Standard writes that the state’s environmental laws are already strict enough as is. “We need to be able to take advantage of at least some of the mineral bounty with which this state is blessed.”

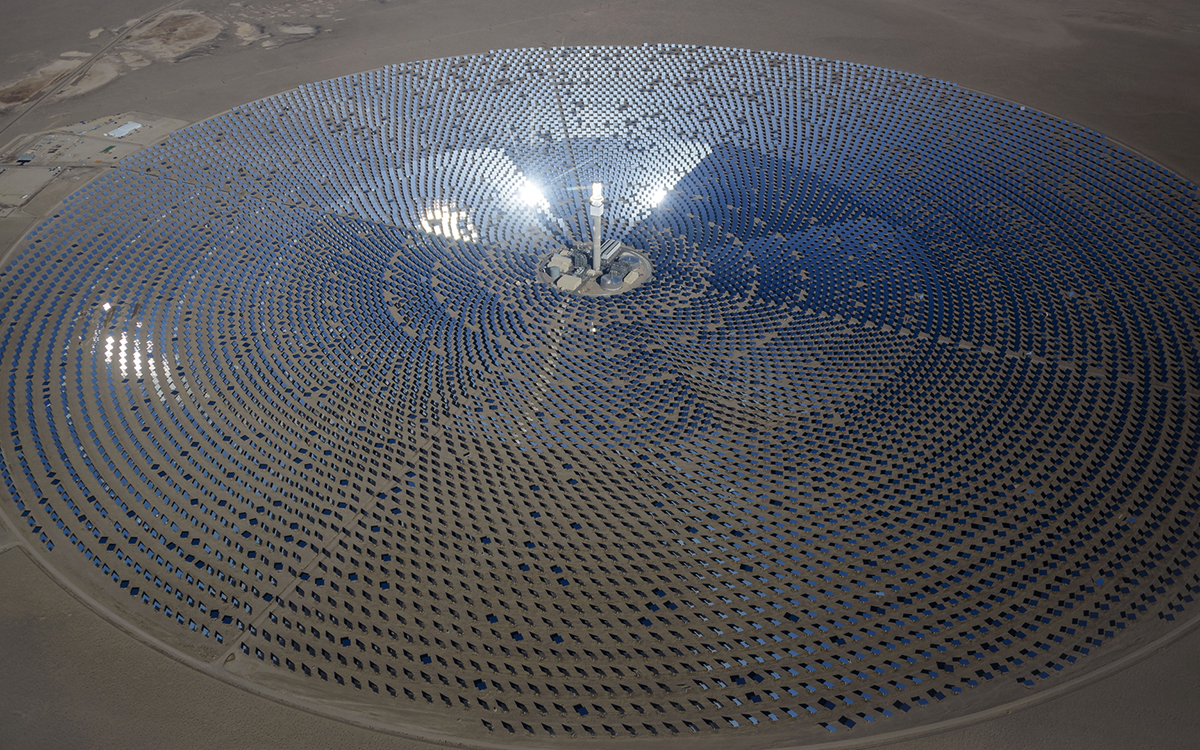

Crescent Dunes Solar Energy Facility in Tonopah, Nevada | Photo courtesy of U.S. Department of Energy

Nevada

Question 6

Nevada’s Question 6, the Renewable Energy Standards Initiative, would boost Nevada’s Renewable Portfolio Standard (RPS) from 25 percent renewable energy by 2025 to 50 percent by 2030.

If you think this reads a lot like Proposition 127 in Arizona, you are correct: Tom Steyer, founder of NextGen Climate Action, is behind this proposition as well, though it hasn’t been as expensive or as contentious as Arizona’s. As Steyer put it to the Nevada Independent, “It turns out Nevada is the Saudi Arabia of solar energy in the United States, and Arizona is number two. Between the two of them they could actually produce enough energy to produce enough electricity for the whole United States.”

Last year the Nevada legislature approved Assembly Bill 206, which would have raised the renewable portfolio standard to 40 percent by 2030. But it was vetoed by the state’s Republican governor, Brian Sandoval. Question 6 is an effort to take the issue directly to the voters.

Question 3

This one is a battle of billionaire versus billionaire. Sheldon Adleson, Donald Trump superfan and magnate of several energy-hungry casinos, is backing Question 3—a.k.a. “The Energy Choice Initiative”—which would require that the Nevada legislature create “an open, competitive retail electric energy market” by 2020. If it’s approved, it would likely force NV Energy, which has a near-monopoly on electricity in the state, to sell its power plants and hand off its power-purchase contracts to new owners, according to a report written by the Public Utilities Commission of Nevada.

NV Energy is owned by Berkshire Hathaway, and Berkshire Hathaway’s CEO is Warren Buffet, an even bigger billionaire than Adleson. So far Adleson’s group—Nevadans for Affordable, Clean Energy—has raised $32.8 million in favor of Question 3, while Buffet’s group—Coalition to Defeat Question 3—has raised $62.3 million to defeat it.

Question 3’s backers promise that deregulation will inevitably lead to lower utility bills, more jobs, and more renewable energy across the state. The Nevada PUC report contradicts this argument, writing that that the customers most likely to see an immediate drop in rates would be “large, commercial customers”—like casinos. The measure would eliminate the PUC’s power to subsidize electricity for low-income users and to set electrical rates for Nevada customers in general.

That means that rates could fall—or they could spike, the way that they did in California after deregulation. The sweeping terms of the deregulation would probably invalidate most of the renewable energy incentives overseen by the Nevada PUC, which would also likely mean less renewable energy in the short term, rather than more.

Rhode Island

Question 3

Question 3 would allocate $47.3 million of state bond money to help the state prepare wastewater treatment plants for climate-change-related storm surges and rising sea levels. It would also pay to repair and remove dams that are threatened by storm surges, rehab wetlands, protect farmland from development, and put in new bike paths. It appears to have not attracted a lot of money or opposition.

“Both coastal and inland communities learned important lessons from the floods of 2010 and the impacts of Superstorm Sandy,” Bill Patenaude, principal engineer with the state Department of Environmental Management, told the Providence Journal. “Given the dollar value and the importance of this infrastructure, we’ll all be better off when we protect it from the wetter storms we’re observing as well as the rising sea levels.”

Washington State

Initiative 1631 is Washington voters’ second attempt to put in place a state-wide carbon tax. In 2016, Washington voters turned down I-732, which would have taxed carbon at $15 per ton starting in 2017, risen to $25 per ton in 2018, and then gone up every year at 3.5 percent until it reached $100 a ton. It was revenue neutral, which meant that it would have returned any revenue raised by the tax in the form of cuts to other taxes. This was meant to appeal to conservatives, but conservatives stuck to party lines and voted against it. Meanwhile, 732 alienated progressives, who thought that any carbon tax revenue could be better spent on climate adaptation and mitigation, especially in low-income communities that are going to be the hardest hit by climate change.

Initiative 1631 is both more and less ambitious. Its carbon tax would start at $15 per ton in 2020 and rise $2 a year until 2035, when it would settle at about $55. Instead of giving that money back in tax cuts, the state will invest it in clean energy and pollution-reduction programs, in kind of a Climate New Deal. The programs will run the gamut from helping low-income people lower their energy bills to helping ecosystems across the state become more resilient. The hope is that this time, enthusiasm and buy-in from the many progressive groups that helped craft this iteration will get it voted in. Its main opponent is the Western States Petroleum Association, which has donated over $21 million to defeat the measure.

A dire new climate change report released recently by the Intergovernmental Panel on Climate Change (IPCC) may also be drawing wallflowers onto the carbon tax dance floor. Both Microsoft and Bill Gates recently endorsed Initiative 1631 after standing on the sidelines for I-732. “Given the scale of the problem,” wrote Gates, “and the fact that we have at best 50 years to solve it, we need to deploy what we have now.” (It is worth noting that, in the aforementioned dire report, the IPCC stated that carbon taxes need to be at $135 per ton by 2030, not $55.)

The IPCC also appears to have tipped the hand of the Seattle News Tribune, which raised concerns about the carbon tax fund but concluded “A ‘yes’ vote will show the country we’re leaders in combating a climate collapse in the next two decades. A ‘yes’ vote will show our grandkids we won’t gamble with their futures.”

The Magazine of The Sierra Club

The Magazine of The Sierra Club