Goldman Sachs Announces It Will Stop Financing Arctic Oil

It’s the first US bank to make such a commitment

Photo by Kiliii Yuyan

On Monday, Goldman Sachs announced that it will not finance new oil drilling or exploration projects in the Arctic, becoming the first US bank to make such a commitment. The bank’s revised environmental policy framework, which was made public Sunday, also includes a ban on financing for new thermal coal mines worldwide.

In explaining its decision, Goldman Sachs cited environmental concerns such as the “potential impacts to critical natural habitats for endangered species” and the negative effects drilling could have on Indigenous communities, which have relied on Arctic ecosystems for their traditional subsistence livelihoods for centuries.

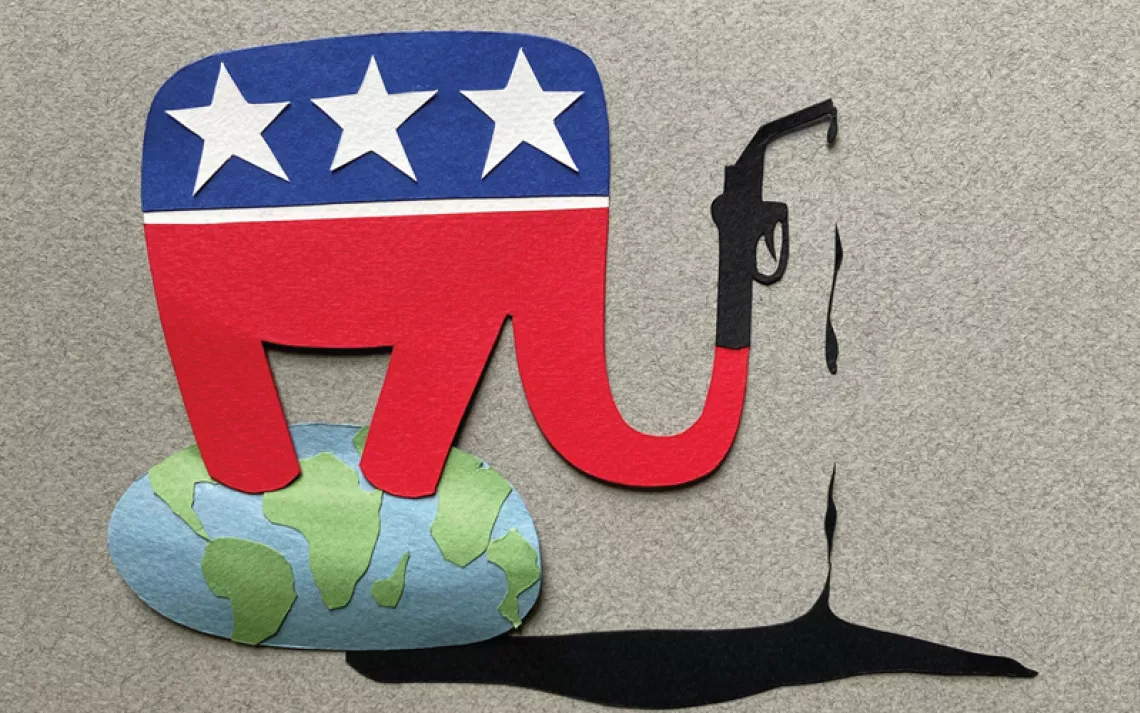

The new lending policy is a win for environmentalists in the fight to preserve the 1.5 million acres of land on the coastal plains of the Arctic National Wildlife Refuge, which the Trump administration proposed opening for drilling in 2017. Since then, the administration has been working to expedite the environmental review process in order to meet its goal of holding a lease sale in the refuge this year, but in November, the Interior Department announced that it would miss this target.

Goldman Sachs’s announcement comes after lobbying efforts led by the Gwich’in Steering Committee, the Sierra Club, and the Rainforest Action Network (RAN). The coalition of environmental groups met with representatives from major US banks over the past several months to urge them to change their lending policies.

“Drilling in the Arctic Refuge would permanently destroy the primary food source of the Gwich’in people, our culture, and our way of life,” Bernadette Demientieff, executive director of the Gwich’in Steering Committee, said in a statement. “We’re glad to see Goldman Sachs recognize that the Arctic Refuge is no place for drilling, and we hope that other banks, and the oil companies they fund, will follow their lead.”

The win is part of a larger strategy led by environmental groups to prevent Arctic drilling by going after funding for the costly oil infrastructure projects needed to facilitate drilling. In response to advocacy efforts, 13 European and Australian banks have already committed not to finance new onshore and offshore Arctic drilling projects.

“The Trump administration may not care about ignoring the will of the American people or trampling Indigenous rights, but a growing number of major financial institutions are making it clear that they do,” Sierra Club campaign representative Ben Cushing said in a statement. “Goldman Sachs is right to recognize that destroying the Arctic Refuge would be bad business, and we hope other American banks will follow their lead.”

While the bank cited environmental concerns as the impetus for its policy change, economic factors likely also played a role. In 2017, Goldman Sachs analyst Michele Della Vigna told CNBC that he didn’t see a rationale for Arctic exploration. “Immensely complex, expensive projects like the Arctic we think can move too high on the cost curve to be economically doable," he said.

In a joint statement, the Sierra Club and the Rainforest Action Network applauded Goldman Sachs's new tougher restrictions on oil and gas projects but also stressed that the bank has a long way to go to align its lending policies with the carbon emissions reductions necessary to keep global temperature rise from exceeding 1.5℃. Most notably, Goldman Sachs’s latest framework left out meaningful changes to its lending policy on fracking and tar sands projects and left a gaping hole in its policy on coal, allowing for the financing of new coal projects if they have “carbon capture storage or equivalent carbon emissions reduction technology (CCS).”

Nevertheless, the new policy could be an indication that major US banks, which until now have been some of the top financiers of fossil fuel projects, are starting to heed calls from climate activists for policies that support combating the climate crisis. In its policy framework, Goldman Sachs acknowledged “the scientific consensus, led by the Intergovernmental Panel on Climate Change, that climate change is a reality and that human activities are responsible for increasing concentrations of greenhouse gases in the earth’s atmosphere.”

The Magazine of The Sierra Club

The Magazine of The Sierra Club