Make Banks Make Good on Their Pledge to End Fossil Fuel Financing

It’s time lenders put their money somewhere else

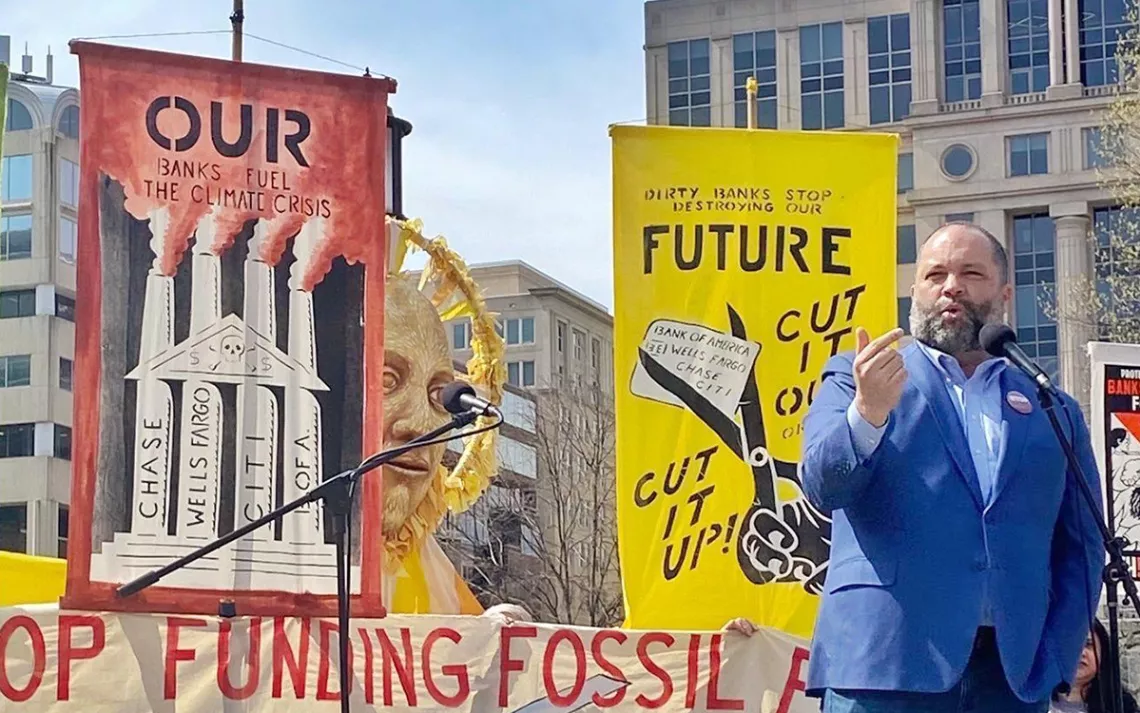

Ben Jealous at DC rally. | Photo by Kelly Holleran

Distributed by Trice Edney Newswire.

ConocoPhillips needs more than the formal approval it won from the Biden administration last week to proceed with its disastrous Willow oil drilling project on Alaska’s North Slope. It needs $8 to $10 billion to build 199 wells, hundreds of miles of road and pipelines, a processing plant, and an airstrip on 499 acres that are vital to caribou, migratory birds, and Indigenous people.

While President Biden certainly could have stopped Willow, so can the financial institutions helping to create it. Willow is just the most recent example of banks’ complicity in preserving fossil fuel extraction through a continuing flow of money to Big Oil and Gas—all despite pledging a year ago to pursue the net-zero carbon emissions we need to save the planet.

That’s why I joined activists from Third Act Tuesday on a block in Washington, DC, to protest at the offices of banking giants Bank of America, Chase, Citibank, and Wells Fargo in our nation’s capital. Third Act is a group founded by environmentalist and author Bill McKibben to bring together Americans over 60 to campaign for a sustainable planet. While I’m still too young to join, I was part of demonstrations they organized at bank branches across the country.

We were there to call out these “dirty” banks’ practices and their unacceptable costs—both immediate and long term. Right now, any money that goes to Willow and fossil fuel projects like it is money that won’t be invested in a clean economy, particularly in fledgling companies that are finding sustainable ways to power the planet. It’s those jobs that Alaskans and their descendants really need.

Longer term, the banks’ lending will weaken the impact of a historic $370 billion investment our country will make in the next decade on green technology and alternatives to oil and gas. As those investments pay off, there will be less and less demand for oil coming from projects like Willow. But the supply will remain steady (for 30 years in Willow’s case). So, gas will be cheaper for the holdouts who continue to use it, making it even harder to push them to make the switch.

The situation got even more dire with the collapse of Silicon Valley Bank and the shadow of doubt it unfairly cast on other regional banks. Banks of that size have been vital to the growth of the clean economy. For example, Silicon Valley Bank reportedly financed 60 percent of community solar energy projects, an arrangement in which property owners jointly construct a solar facility to power their neighborhoods.

The consequence of the turmoil has been to concentrate even more power in the biggest banks. Bank of America, for example, took in close to $15 billion in new deposits in a matter of days after Silicon Valley was taken over by federal regulators.

That makes it even more imperative that we hold these banks to their pledges not to fund new fossil fuel projects (HSBC, Europe’s biggest bank, is keeping that promise). Third Act has suggestions that most people can take to be part of that accountability: Cut up credit cards issued by the banks and move deposits out of them, not into them. When more and more people do that, they will be strengthening the case of a small group of the banks’ investors who have begun introducing resolutions at shareholder meetings calling for an end to fossil fuel financing.

Throughout our country’s history, it’s been profitable to consider certain people and places as disposable. We know where continuing that unjust path will lead—to a planet that’s too polluted and too hot to be livable. We’ve passed the time when financial institutions can postpone an end to their investment in the climate’s demise. It’s time these dirty banks put their money somewhere else.

The Magazine of The Sierra Club

The Magazine of The Sierra Club