What PG&E's Near-Bankruptcy Can Tell Us About the Future

This deluge of climate disasters is a sign of what’s to come for utilities

Even after a court ruled last week that private equipment—not equipment owned by Pacific Gas & Electric—started the deadly Tubbs Fire in 2017, things are looking ominous for PG&E. It’s the largest investor-owned utility in California. It’s also, at present, accused of being one of the most regular fire-starters in California and edging toward junk bond status and possible bankruptcy.

California regulators have linked 17 of the 21 major fires in the state in 2017 to PG&E. Some of those fires appear to have been sparked by equipment failures, and others to power lines brushing up against trees that the utility was legally obligated to keep pruned. Judge William Alsup of the US District Court for the Northern District of California said PG&E needs to reinspect its entire electric grid, trimming and/or removing any trees that could fall and take out equipment during a windstorm.

Not possible, replied PG&E, in another court filing. Removing a single tree costs $1,250. Removing and pruning enough trees to bring the wildfire risk down to zero could cost anywhere from $75 billion to $150 billion. Also, PG&E said that it doubted there were even that many tree-trimmers in the state.

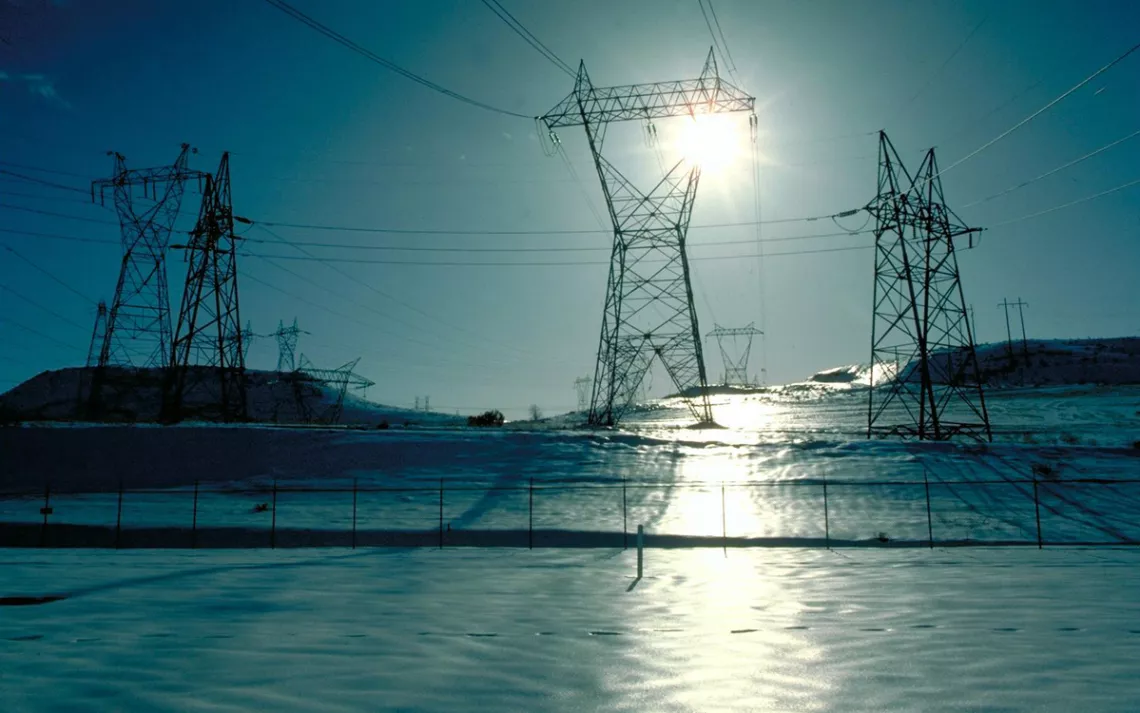

Climate change is making the business of PG&E—and utilities across the West—much more uncertain. Climate change’s extreme weather—the snowpocalypses, the polar vortices, the rainy seasons that make plants grow lush, and the droughts that reduce that lushness to tinder—is going to change the way that utilities function and do business across the country. Here’s how PG&E’s situation could be a sign of things to come:

If people live in wildfire-prone areas, they may not have year-round electricity.

Judge Alsup recently told PG&E via court order that, during wildfire season, the utility needs to turn off electricity to windy areas, even if it means lost profits and angry customers. This means that especially wildfire-prone areas could lose their connection to the grid for days—even weeks—at a time.

According to the US Forest Service, some 32 percent of housing units across the country, and one-tenth of all land with housing, are located in the wildland-urban interface. In the wildlands, fire is a part of the natural ecology. In suburban areas nestled up against forest lands and other wild areas, fire is a risk to nearby real estate.

PG&E has pushed back against Alsup’s new rules. Depowering high-voltage transmission lines is not easy, the utility argues, and could disrupt connections to other grids as far away as Nebraska, South Dakota, Texas, Alberta and British Columbia, and Baja California. But the company already carried out its first depowering in October when it cut power to 60,000 customers in the Sierra Nevada foothills after a weather report announced a risk of high winds.

Frequent depowering could further widen the economic divide between urban and rural areas by making it harder for rural residents and businesses to make a living. But with the right incentives, seasonal depowering—and the inconveniences it causes—could also jump-start development of microgrids, smart grids, and renewable energy in the areas that are the worst affected.

Electricity will definitely get more expensive.

Californians already pay some of the highest rates for electricity in the country (though bills are lower, overall, because of climate and energy-efficiency measures). In September 2018, state legislators gave PG&E a partial bailout by approving SB 901, which gave the company the ability to pass some of its 2017 wildfire costs on to ratepayers via utility bills.

No word yet as to whether 2018’s wildfire season will also prompt a rate hike, but the outlook for ratepayers doesn’t look good. PG&E currently has about $800 million in liability insurance for potential losses in connection with the wildfires, and the utility is facing losses of billions of dollars more.

Even in states with lower immediate wildfire risks, utility bills are still likely to go up, because more extreme weather leads to more dependence on heating and air conditioning.

Public utilities are going to start to look pretty good to some people.

In the past, PG&E has been charged with skimping on safety measures and avoiding expensive, long-term projects. Burying power cables underground, where they are less likely to start wildfires, is one of those projects that appears to be skimped on—$246 million that the utility set aside for undergrounding wires went unspent.

When a PG&E natural gas pipeline exploded in a residential neighborhood in the San Francisco Bay Area suburb of San Bruno nearly a decade ago and killed eight people, an independent audit by the California Public Utilities Commission found that PG&E had funneled money that it had set aside for safety and maintenance into bonuses for executives and profits for shareholders. In the last few years, PG&E has also significantly raised the amount of money it dedicates to lobbying state officials, so much that last year, it was spending more money on lobbying than Chevron does.

State senator Jerry Hill, a Democrat, whose district includes San Bruno, is working on a bill that would break up PG&E into smaller, regionally controlled public utilities that could, in theory, be more focused on safety and maintenance, since they wouldn’t have the same pressure to return revenue to shareholders that private utilities do.

There’s been a lot of talk recently about how tackling climate change requires both grassroots activism and adaptation at the local level and massive infrastructure projects (like a national smart grid) that haven’t been seen since the New Deal era. Given that FDR was a big fan of public power, a shift like this would be as much of a throwback as it would be a move toward a different future.

The Magazine of The Sierra Club

The Magazine of The Sierra Club