New utility-scale solar facility west of Fort Stockton

By Cyrus Reed

Y’all might not know this about me, but I spend several hours a month sitting in meetings over at ERCOT--the Electric Reliability Council of Texas, our independent grid operator--and then a good amount of time either sitting in or watching meetings of the Public Utility Commission (PUCT). Over the last several years, I’ve spent countless hours in discussions and filing comments about whether there would be sufficient electric generation to meet our ever-increasing demand for electricity, and whether prices were sufficient in our market to incent new generation.

There has been widespread concern during these discussions. Just in 2019, there were two days when ERCOT followed market rules and, due to extremely tight margins, ordered “Emergency Response Service” (both back-up generators and demand response) to make sure that the lights stayed on. These events actually followed normal ERCOT protocol, but some individuals cited the tight margins to claim (falsely) a need to prop up older, dirtier resources, or create extra “capacity” payments as some markets do, all supposedly in the name of reliability.

This month, ERCOT released the December installment of its Capacity, Demand and Reserves Report, usually referred to as the “CDR.” ERCOT had a rather sunny disposition: reserves (meaning the amount of extra generation capacity produced at our highest peak use) will go up in 2020 after several years of very tight margins. This is mainly due to additional solar resources, and better accounting of electricity generated by wind farms in the Texas Panhandle.

So what does the report say--do we have enough juice?

Let’s break it down.

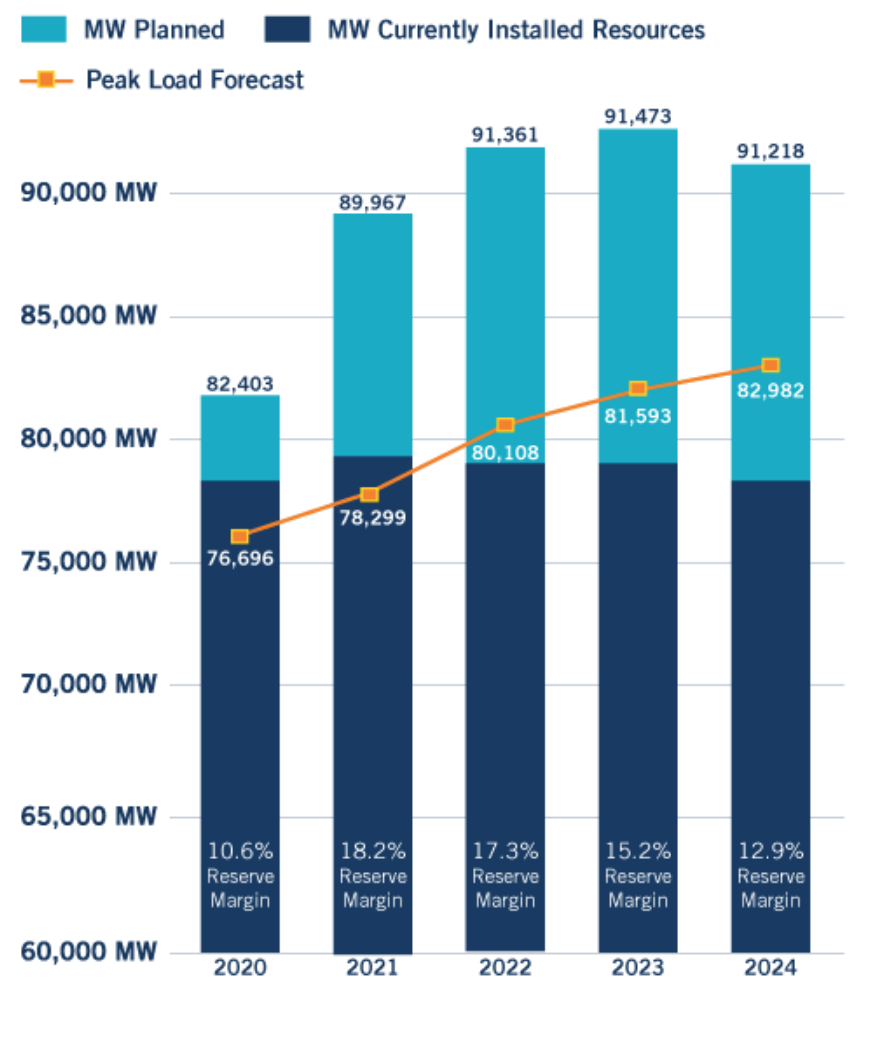

The CDR takes all of the existing electric generation (including coal, gas, nuclear, wind, solar and hydro); subtracts any officially announced retirements; and adds in those resources that have obtained any required air-quality or water-related permits, have obtained financing, and have completed an interconnection study with a transmission company. In this way, there is some assurance that the generation will actually get built in the coming years.

In addition, the CDR predicts two important factors: first, how much “peak demand” (i.e., the single-highest use of electricity during an hour on a hot summer day) Texas will use; and second, how much energy efficiency and demand response will be used to counteract peak demand. The CDR predicts five summers ahead accounts for alternate scenarios, such as what would happen if announced retirements were actually implemented.

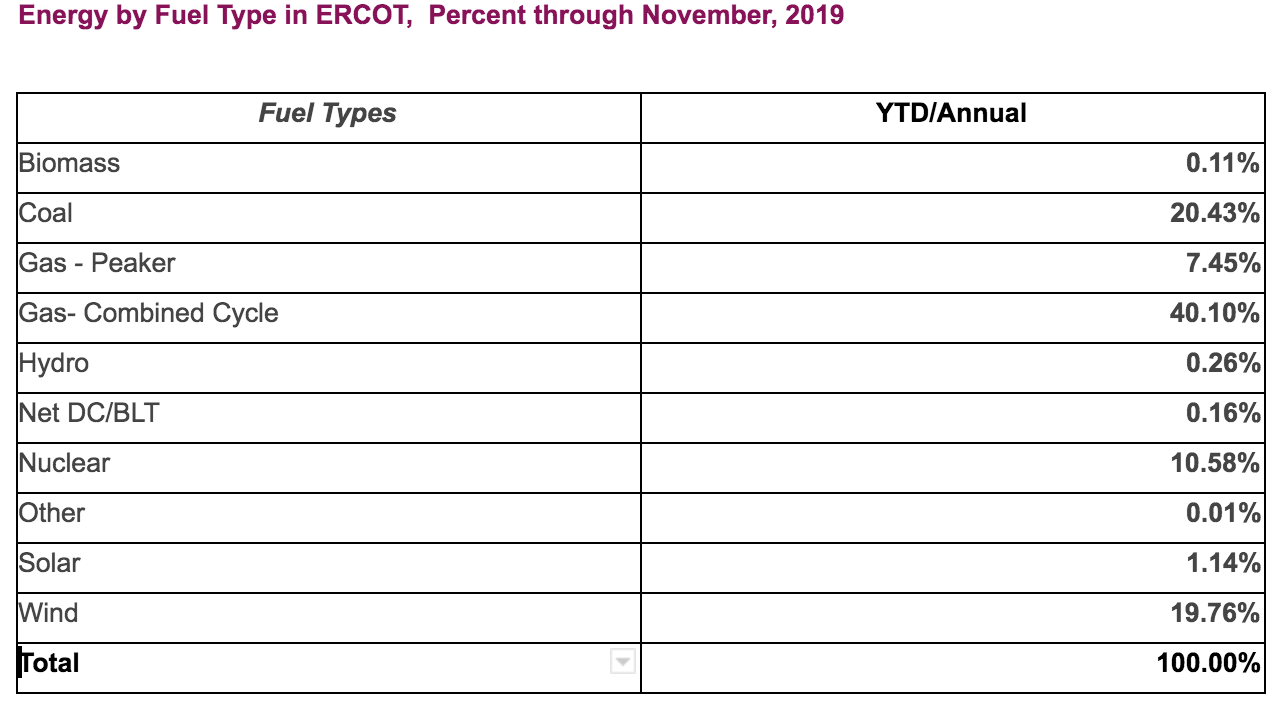

Source: ERCOT, http://www.ercot.com/news/releases/show/195806.

The latest reports predict the reserve margin for the summer of 2020 to be 10.6%, which is 2% higher than the 8.6% reserve margin ERCOT reported for summer 2019’s peak demand season. For 2020, the forecasted peak demand is 76,696 MW. ERCOT’s current system-wide peak demand record is 74,820 MW, set on August 12, 2019, between 4 and 5 p.m.

In terms of new resources, two large gas-fired plants totaling 1,227 MW have been canceled, and some solar power plants delayed. But we can look forward to primarily renewable resources in 2020, including--283 MW of solar plants, 677 MW of wind-- and just two small gas peaker plants near Victoria of 44 MW each. ERCOT is adding one battery storage plant, though they are not yet giving storage “credit” for energy at peak until a methodology is developed through the ERCOT process.

Looking into 2021 and beyond, reserve margins are expected to rise further, as more solar and wind resources are added. In fact, out of some 4,500 MW predicted to come online in the next two years, all but 128 MW (which are from two small gas resources located in Brazoria County) are from wind, solar or storage. Solar tops the list, with some 2,700 MW of new generation that is likely to be built.

How does the CDR count summer peak capacity for storage, solar, and wind?

Like I said, ERCOT has not determined how to predict how much capacity of storage can be assumed at peak, and has not credited any electricity from storage as coming online during this high-use period. Market participants are currently reviewing a proposal to give some credit to storage capacity during summer peak in future CDRs.

As for wind and solar, ERCOT follows market protocols, which take the actual top 20 hours of capacity over several years, and average it to come up with a capacity figure.

For solar in particular, ERCOT currently credits solar with 76% of its total capacity. It values wind by geographic zone. The values range from 16% for south and west wind; 29% for Panhandle wind; and 63% for wind along the coast. There was a time when ERCOT only valued wind at some 8% during peak time, but wind’s production during peak times has far surpassed these conservative values. The new values for Panhandle wind are a recent change and help better predict how much juice ERCOT will have next summer.

What about coal?

When I first started working for Sierra Club in 2007, we were in the middle of the coal “rush,” where it seemed like every other day there was another announcement about new coal. In 2019, that is no longer the case, and there are no new coal plants being proposed. In fact, some coal plants, like Gibbons Creek near Bryan, are now off the table, having been retired. And another coal plant, OKLAUNION U1 in North Texas, is expected to retire in late 2020.

In terms of energy use, for the first time in ERCOT, electricity from wind and solar actually surpassed electricity from coal through the first 11 months of the year within ERCOT. The times they are a-changing, though much more is needed!