By Cyrus Reed, Conservation Director

Let’s start with the big picture, which generally looks pretty optimistic. In Texas’s main electric grid known as ERCOT (Electric Reliability Council of Texas), which covers about 80 percent of the state, renewable energy and storage continue to grow and provide more and more of the share of electricity (even with higher peaks and energy use). And future projects tilt heavily toward renewable energy and storage. Even a recent announcement of the reopening of a mothballed Gibbons Creek coal plant is on hold as a potential “buyer” tries to convince the four cities that own it that they have a viable path to reopen the dirty, antiquated plant. In fact, most recently, a new buyer stepped in and announced they had no intentions to run a coal plant at all, but only wanted the land for redevelopment - including potentially adding renewable energy -- meaning there are no plans for any additional coal in Texas. (But we are watching just to make sure!)

Let’s look at some of the numbers in ERCOT. Through the first eight months of the year, fossil fuels led by gas was still the overwhelming leader in terms of electricity power at about 48 percent of all electricity provided. Wind however provided almost 23 percent, while solar added another 2 percent, with coal (17 percent) and nuclear (10.5 percent) making up the rest. Other resources, including storage, provided less than one percent.

Energy by Fuel Type, January-August 2020

|

Fuel Type |

Percent of Total Electricity Use |

|

Coal |

16.8% |

|

Gas |

47.1% |

|

Nuclear |

10.6% |

|

Wind |

22.6% |

|

Solar |

2.3% |

Source: ERCOT, Energy and Demand Report, September 2020

Projects being considered for the future seem, on the surface, pretty good. In particular, despite several gas projects moving forward that could be built, the amount of storage proposed is more than twice the amount of gas, wind is more than three times as much, and about 10 times more solar is being proposed than gas. Although it is possible that many of these renewable projects may never be built, it’s important that developers are putting time and money into screening studies, financial investments and interconnection studies indicates the trend in ERCOT is largely renewables and storage. In other words, investors are demonstrating some sort of belief that the future for the most part is not in fossil fuels, but in renewables and electric storage.

Major Generation Projects by Fuel/Technology Type, MW

|

Fuel Type |

MWs of Projects, in Screening Study Process |

MWs of Projects, Screening Study complete, with Interconnection Agreement |

Total Projects |

|

Gas |

5,225 |

1,799 |

7,024 |

|

Coal |

420 |

0 |

420 |

|

Storage |

16,487 |

950 |

17,436 |

|

Wind |

12,426 |

13,640 |

25,886 |

|

Solar |

63,389 |

13,572 |

76,961 |

|

Total |

98,130 |

29,960 |

128,090 |

Source: ERCOT, August Generation Interconnection Study Report, September 2020.

Another exciting process at ERCOT is that stakeholders have been meeting and developing rules on how to treat new energy storage resources so they can compete in the market. Known as the Battery Energy Storage Task (BEST) Force, advances are already occurring and developers are responding with several large storage facilities being constructed right now in ERCOT, including a 100 MW giant battery facility just outside of Fort Worth.

So why the long (transmission) face?

There’s an ongoing issue in ERCOT that is already creating congestion and preventing clean renewable energy to get on the market, and it boils down to a lack of transmission. While a blog can not due justice to an issue as complicated as transmission planning, this is the issue in a nutshell: in ERCOT, transmission is built by transmission companies in response to new growth in demand, and approval goes through the ERCOT and Public Utility Commission process. This wasn’t a big deal in the past when we built mostly gas and coal plants, because it took them three or five years to get financed and then hooked up to the transmission grid. Essentially, the transmission was in place to get their energy on the market by the time the plants were built.

But renewable energy and storage facilities can be built relatively quickly- usually in less than a year. In an open-access market like ERCOT, developers are building these resources fast, and transmission companies are not required to build out transmission to serve those generators other than to make sure they have access to the grid. In other words, we don’t build transmission to serve generators, we build transmission to serve load.

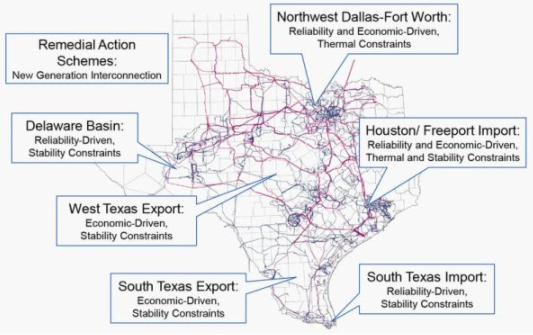

What this means is that in several places on the ERCOT grid, ERCOT has already implemented what is known as “Generic Transmission Constraints,” or limits on generation output so that transmission lines don’t exceed their capacity. Currently, there are over a dozen Generic Transmission Constraints (GTCs) in ERCOT. As an example, right now ERCOT has placed limits on the generation coming largely from wind facilities from both West Texas and the Panhandle to the rest of the state. This has limited the amount of generation that is allowed to run on those lines to about 80 percent of what generators are actually able to generate.

Map showing some Generic Transmission Constraints in ERCOT

Source: Tom Klecker, RTO Insider, ERCOT: Transmission Constraints an Emerging Issue, August 25, 2020

Let’s consider some recent scenarios developed by ERCOT staff known as the Long Term Assessment Study. While the LTSA study is ongoing, ERCOT staff recently released one of their “scenarios” in which ERCOT assumed that current “Generation Technology Constraints” continued to operate meaning facilities in areas like South Texas and West Texas couldn’t get all of their power into the state’s main load centers. The model essentially shows that even though ERCOT would expect to build more solar, storage and wind facilities into the future, developers would react to the lack of transmission capacity and also build large gas facilities near the large cities, essentially overbuilding generation (fossil-fuel generation) to meet those demand needs. In fact, ERCOT found that by 2035 about a third of the time, ERCOT would need to restrict the output of West Texas solar and wind farms because of these constraints.

Compare that to a model in which ERCOT assumes we do not have the transmission constraints. What happens? Fewer gas plants get built, because abundant West and South Texas wind and solar can get energy to the market, and consumers save money. As an example, in ERCOT’s current trends model, renewable energy would provide more than half of all electricity by 2035-- but if the major GTCs go unsolved, then more of our electricity would come from gas than from renewable sources according to these studies.

ERCOT Long-Term Study Assessment Scenarios

|

Current Trends, no constraints |

Transmission Constraint Scenarios |

Difference Between Current Trends and Constraints |

|

|

New Renewables Generation by 2035 (MWs) |

67,900 |

62,700 |

-5,200 MWs |

|

Total Electricity Coming From Renewables (%) |

53% |

47% |

-6% |

|

New Gas by 2035 (MWs) |

18,146 |

20,979 |

+2,833 MWs |

|

Total Electricity coming from Gas in 2035 |

35.45% |

43% |

+7.45% |

|

New Storage by 2035 |

2,023 |

3,469 |

+1,446 |

|

Scarcity Hours |

35 |

23 |

-12 |

|

% of time when West Texas Output is constrained |

0% |

35% |

+35% |

Source: ERCOT, LTSA Presentations to Regional Transmission Planning Group, May and September 2020

Are there solutions?

Stakeholders and ERCOT are examining the issues and there are many solutions. One is to start changing some of the inputs that ERCOT considers when giving approval to transmission projects moving forward. There is an extremely high hurdle to getting transmission approved in ERCOT if it is not needed for reliability purposes. Any transmission that is needed to increase production from lower cost resources needs to have an economic justification. But the inputs used for ERCOT and the PUC’s economic justification don’t really consider the savings that come from the use of lower cost resources like solar and wind. However, there are relatively simple changes that ERCOT could consider to better reflect the savings that result when more generation, like cheaper renewables, actually are allowed to flow onto the system that would make transmission able to meet the economic justification.

Second, giving some flexibility to consider building smaller transmission upgrades that can be accomplished faster -- as well as allowing non-wires alternatives such as storage or peak shaving programs - that reduce stress on transmission lines can allow more juice to flow on the lines.

The third and more difficult solution would be a legislative one. We have done this in the past: legislate more transmission build-out like we did when we originally created the Competitive Renewable Energy Zones. In that case, the Legislature ordered the PUC to work with transmission companies to create the lines to bring energy from West Texas to the demand centers in the east. This “build it and they will come” model worked so well that it caused our lines to be overloaded! (Many of us argued back in 2011 as lines were being built that they should have made them bigger from the beginning.)

However, that model is no longer allowed under state rules, bringing us to the present conundrum.

Look for more discussions at ERCOT, the PUC and maybe even the Legislature as stakeholders try to figure out how Texas can grow a carbon-free grid. Transmission is key. Whether it’s big lines in West Texas or more nimble non-wires alternatives, both need to be part of the solution if we are to ever move from 25% renewable energy, as we are today, to 50, 75 or even 100% over the next 10 to 20 years.