Nevada is “Battle Born,” founded to support our nation with our mineral wealth during the Civil War. Since 1864, Nevada has served our country by providing non-renewable minerals. During that time, our minerals have also made corporations rich. And Nevadans have been left a toxic legacy at great expense. Nevadans have given enough. It’s time mining corporations pay their fair share, especially now with an economy ravaged by COVID. The Nevada Legislature is considering two resolutions to have mining proceeds help support Nevada’s struggling budget.

Take action today by signing this petition of support for AJR1** to the Nevada Legislature today.

The mining industry is lobbying hard and spending millions to fight this. Please #DigDeep and take additional steps:

1. Please also share your opinion in favor of AJR1** on the Nevada Legislature website.

This link will take you to the Nevada Legislature’s website. Simply look up the bill number (remember to search "AJR1**"), fill out your information, mark your position as “In Favor”, then share your reasons why. Use any of our points here to inspire your comments.

2. If you tweet or post on Facebook, please share this with your friends, or search for #OursNotMines, #DigDeeperNV, and #AJR1**, then retweet and amplify your favorite posts you see. Please follow us @SCToiyabe on Twitter.

Mining companies have enjoyed a sweetheart deal from Nevada since the state’s founding in 1864. As COVID has ravaged Nevada’s economy, the price of gold and other metals has surged (see this NPR report on gold prices at record highs). Now, with an economy ravaged by COVID, it’s time they pay their fair share.

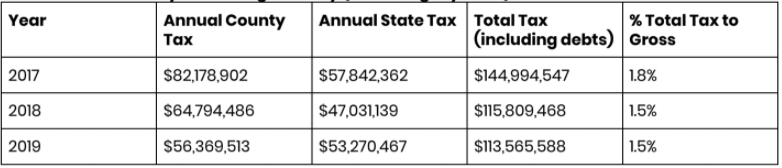

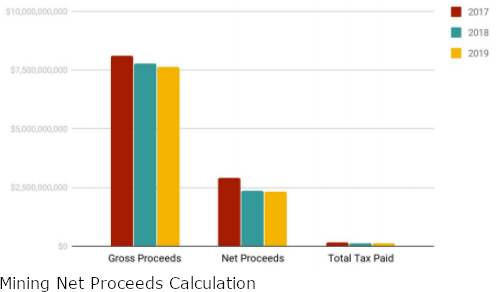

Entrenched in Nevada’s Constitution is language that limits mining taxes to no more than 5% of Net Proceeds (the amount of money mining brings in after deducting expenses). In 2019, the Mining Industry’s total contribution to the state budget was 1.5% of Gross Proceeds of $7,634,509,664, according to state archives. Nevada consumers contributed 29% in sales taxes to the general fund.

Source: Nevada Department of Taxation Net Proceeds of Minerals

Why a Mining Tax is Needed

Nevada has the 5th most regressive tax structure in the nation, meaning those with the least money pay the highest tax rates. For example, Nevadans making less than $20,500 a year pay over 10 percent of their daily income in taxes, while the mining industry pays less than 1 percent of their gross income into the state general fund. And when the economy stumbles, the price of gold soars, making Nevada’s mineral wealth a great stabilizer of our economy. During the pandemic, Nevada's economy has stumbled indeed. Among the hardest-hit sectors were education and health care, two of the most critical social services during the pandemic. And as with climate change, air pollution, and other impacts, Latinx and other communities of color have been hit hardest by these impacts.

The Net Proceeds Loophole

Per NRS 362, mining gets 12 deductions, including ordinary business expenses like cost of delivery and transportation. The industry may deduct cleanup costs, even if they are responsible for the environmental degradation. The 2019 deductions amounted to more than $5 Billion out of nearly $8 Billion. In 2019, 13 gold and silver mines paid no taxes. That’s almost $700 Million not taxed at all. This multi-billion-dollar industry, headquartered in other countries, simply does not pay their fair share for extracting valuable minerals from Nevada.

Hobbling on a Three-legged Stool

A fair and equitable tax structure attempts to spread taxation fairly across as many sectors of the economy as possible (to diversify risks and income by not putting too many eggs in one basket). Tax economists often talk about the three legs of a sound tax structure: income tax, sales tax, and property/land tax. However, in Nevada, we have no income tax (one leg gone, because taxes on the gambling industry have replaced Nevada’s income tax, which worked fine until the pandemic destroyed our gaming and tourism economy), and we are the only state in the Union with a depreciating property tax structure, which brings ever-diminishing funds to municipalities for infrastructure and services for which the prices continue to rise (another leg gone). This leaves income tax as the only major tax base for revenue. Nevada has the 12th highest state and local sales tax rates.

Sales taxes are the most regressive tax. This means low-income people pay the highest percentage of their income on taxes. A higher mining tax rate would boost Nevada’s state budget without impacting lower-income residents.

Background

Nevada’s constitutional language on mining taxes was written when all mining was done with picks, shovels and mules. Today, mining in Nevada takes place at a much grander scale. Currently, Nevada ranks after China, Australia, and Russia as the 4th largest gold producer in the world. Nevada also produces copper, silver, barite, gypsum, lithium, and diatomite, generating more than $8.7billion in wealth in 2017 alone.

Unfortunately, international and foreign-owned conglomerates, such as Vanguard, BlackRock (the financial firm, not the desert), Fidelity Investments, VanEck, Flossbach von Storch, RBC, and Global Asset Management own most of the mining corporations in Nevada. The wealth these companies extract from your public lands lines millionaires' pockets rather than reimbursing Nevada for the loss of these non-renewable resources. Nevada mining companies all benefit from our education system, healthcare system and infrastructure. The least they can do is pay their fair share to support these same services.

The Nevada Mining Association is proud of their charity to local communities. However, charity is a poor substitute for lasting and reliable policy that modernizes revenue or for services provided by the state to support the mining industry.

The Nevada Legislature is currently considering two resolutions to increase the mining tax revenue: Assembly Joint Resolution 1** (AJR1**) and Assembly Joint Resolution 2** (AJR2**). The asterisks indicate these bills were passed during the 2020 special session, but they must pass again, then be ratified by Nevada voters in 2022 to be enacted.

AJR1** Overview - Support

This would revise the State Constitution to impose a tax of 7.75% on the gross proceeds of all minerals extracted in the state. Twenty-five percent of the monies collected would be directed to fund education and health care, and 75% would go to the general fund without restriction. It allows for future increase with simple majority vote. If it passes the current 81st session of the Nevada Legislature, it will go before the voters for ratification and approval in the 2022 General Election. Estimated Revenue: $607 Million, the largest increase to the state budget of the three proposals.

AJR2** Overview - Oppose

AJR2** is a proposed constitutional amendment that would raise the limit on the net proceeds of minerals from 5% to 12%, and require the minimum rate of the tax be equal to the property tax where the mining operation is located. However, this would encourage mines to find more deductions to lower their taxes (like we all do when doing our own taxes). In fact, nearly half of Nevada's mines paid $0 in taxes in 2019. This will likely continue if AJR2** passes. Estimated revenue: $260 Million.

Sierra Club supports AJR1**. Why?

Both resolutions would increase mining revenue to the state. However, the Sierra Club strongly supports AJR1**, because it will generate the most money for education and other essential services in Nevada.

YOU pay a higher tax rate than these multi-billion dollar corporations. Why shouldn’t they pay their fair share?

Over the last 150 years, mining has inflicted a growing list of harms on Nevada’s communities, water, wildlife, citizens, and economy. It’s time mining companies pay their fair share for the wealth they extract from YOUR public lands.

Click here to support AJR1** at the Nevada Legislature today.

Please also take the additional actions listed near the top of this blog.

In supporting AJR1**, Sierra Club joins Progressive Leadership Alliance of Nevada, Battle Born Progress, Nevada Conservation League, Chispa, the Nevada Environmental Justice Coalition, the Nevada State Education Association and others.

What else can you do?

Share your support for AJR1** and mining tax reform on social media. Search for #NVLeg, #OursNotMines, #DigDeeperNVLeg

Learn more by reading these articles

Nevada Current: Nevadans demand action on mining tax to meet a growing state’s needs

Sierra Nevada Ally: Joint resolutions would more than quintuple state taxes on mining in Nevada

This article shows that if AJR1** had been in effect in 2019, the state would have realized an additional $500,187,784 in revenue over the current system.

Fool’s Gold: The Silver State’s Tax Structure: Inadequate and Inequitable. This 2009 PLAN report compiled research by Robert Ginsburg on Nevada’s regressive tax structure and mining’s failure to pay its fair share.

Support Sierra Club’s work to protect our lands, waters, wildlife and communities from the impacts of mining. Donate today to hold mining counties accountable.