In the last two years, many of the world’s largest financial institutions – including some of the world’s largest asset managers – have made commitments to manage their investments in line with the goals of the Paris Agreement. Despite this, institutional investors like BlackRock, Vanguard, and State Street, which manage the investments and retirement savings of millions of Americans, have continued to pour billions of dollars into companies that are building out new fossil fuel projects and locking us into a carbon fueled future.

Institutional investors have two big sources of power. As investors, they get to decide where, how, and how much of theirs and their clients’ money they invest. As shareholders, they are partial owners of many companies, which means they get to leverage their influence over corporate decisions by using their proxy voting power. By using these two in tandem, institutional investors can have a huge influence in steering the expansion or decarbonization plans of fossil fuel companies and other corporate polluters.

2023 ASSET MANAGER SCORECARD

This year’s scorecard, “Who’s Managing Your Future? An Assessment of Asset Managers’ Climate Action” published by Reclaim Finance in partnership with the Sierra Club and other advocacy groups, assesses how effectively the climate policies of the world’s largest asset managers have translated to real-world emissions reductions in the fossil fuel sector. The scorecard reveals that asset managers like BlackRock, Vanguard, and State Street are well behind the curve of where they need to be in order to hit global climate goals.

Very few asset managers across the globe are taking steps to stop financing companies engaging in fossil fuel expansion, and very few are setting the right expectations for how they will hold companies accountable for their contributions to the climate crisis. This includes weak, inadequate policies about how they will use their shareholder power to influence corporations to act.

- Read the report: “Who’s Managing Your Future? An Assessment of Asset Managers’ Climate Action”

- Read the press release: New Analysis Reveals Asset Managers' Complicity in Fossil Fuel Expansion

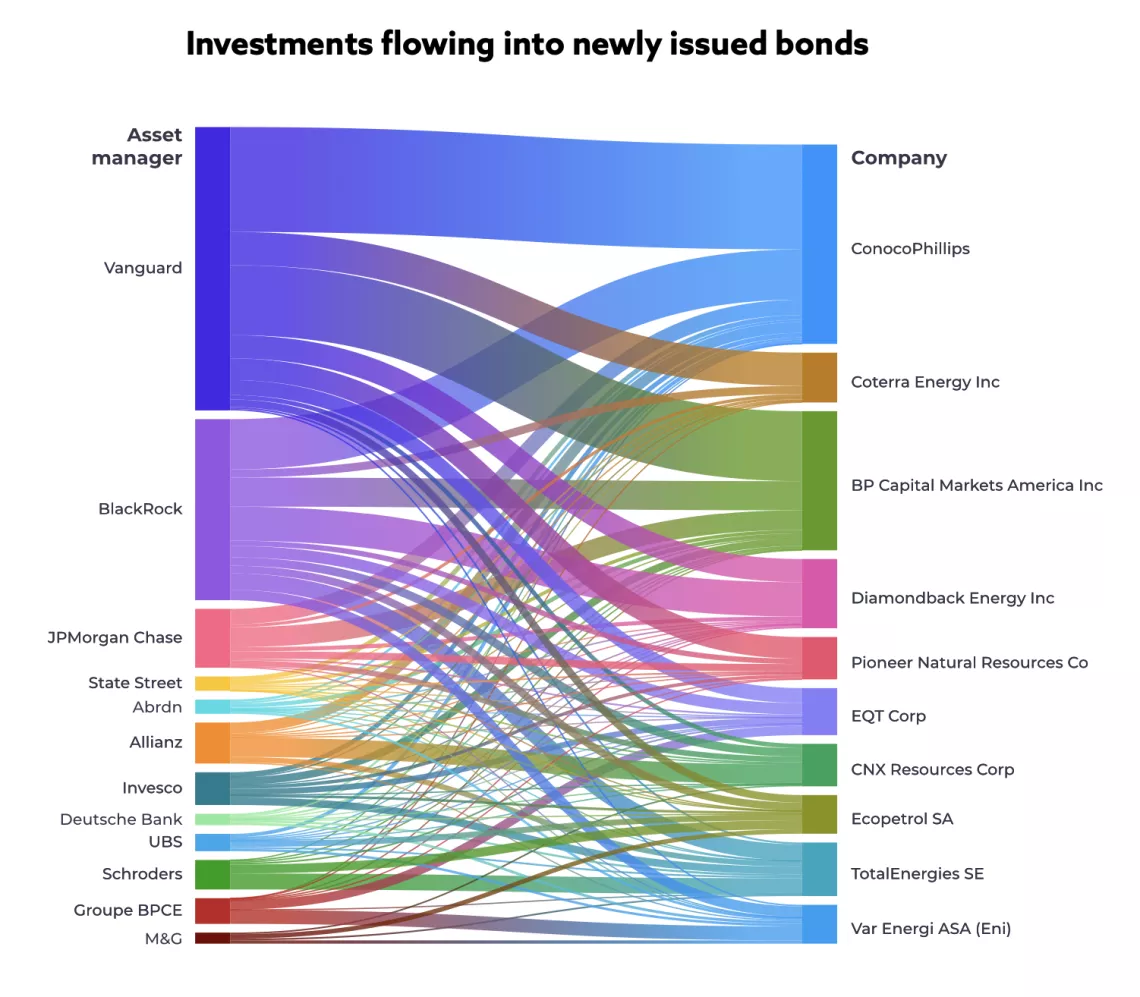

The scorecard reveals that the two worst offenders are US-based asset managers BlackRock and Vanguard. All together, the 30 asset managers profiled in the scorecard invested $3.5 billion in new bonds issued by 38 companies expanding fossil fuels over an 18-month period (2021-22). More than 34% of that $3.5 billion came from Vanguard, and an additional 24% came from BlackRock. In other words, just two asset managers purchased 58% of the bonds issued by companies expanding fossil fuels. These two asset managers are disproportionately responsible for the role the entire global asset management sector plays in financing the companies responsible for expanding fossil fuels and driving us toward climate catastrophe.

The performance of these asset managers on setting expectations around their fossil fuel financing and proxy voting aren’t much better. Neither Vanguard nor BlackRock have policies that would restrict investments in companies involved in fossil fuel expansion. These asset managers also have vague, in the case of BlackRock, or nonexistent, in the case of Vanguard, expectations of fossil fuel companies in general. Despite having enormous shareholder influence and proxy voting power to engage with polluters, they are, in effect, doing very little to hold these companies accountable for their greenhouse gas emissions.

While BlackRock and Vanguard are the worst offenders, the 2023 scorecard reveals a collective failure from the asset management sector. While the report highlights some exceptions – a few European asset managers have set clear expectations for oil and gas companies – the majority of asset managers ranked in the scorecard are setting the bar too low, calling only for climate disclosures or long-term targets. In other words, most asset managers simply accept the climate goals set by polluting companies, effectively signing off on a company’s greenwashing without actually holding them accountable to meeting their climate pledges. With such a low bar pervasive throughout the asset management sector, it’s hardly surprising that fossil fuel companies aren’t taking near-term steps to decarbonize.

WHAT PENSIONS FUNDS – AND THEIR ASSET MANAGERS – CAN DO

It’s clear that the world’s largest asset managers are not acting in their clients’ best interests when they choose to avoid taking comprehensive action on mitigating climate change and the risks posed by it. Asset owners, like pension funds and endowments, that are committed to comprehensive climate strategies, and that want to support the best interests of their beneficiaries, need to push their asset managers to take real action. In practice, this means demanding that asset managers not provide new debt financing to fossil fuel expanders, and use their shareholder power to hold the management of big polluters accountable. This two-fold approach is the best way for asset managers to have a real-world impact on fossil fuel companies and global greenhouse gas emissions.

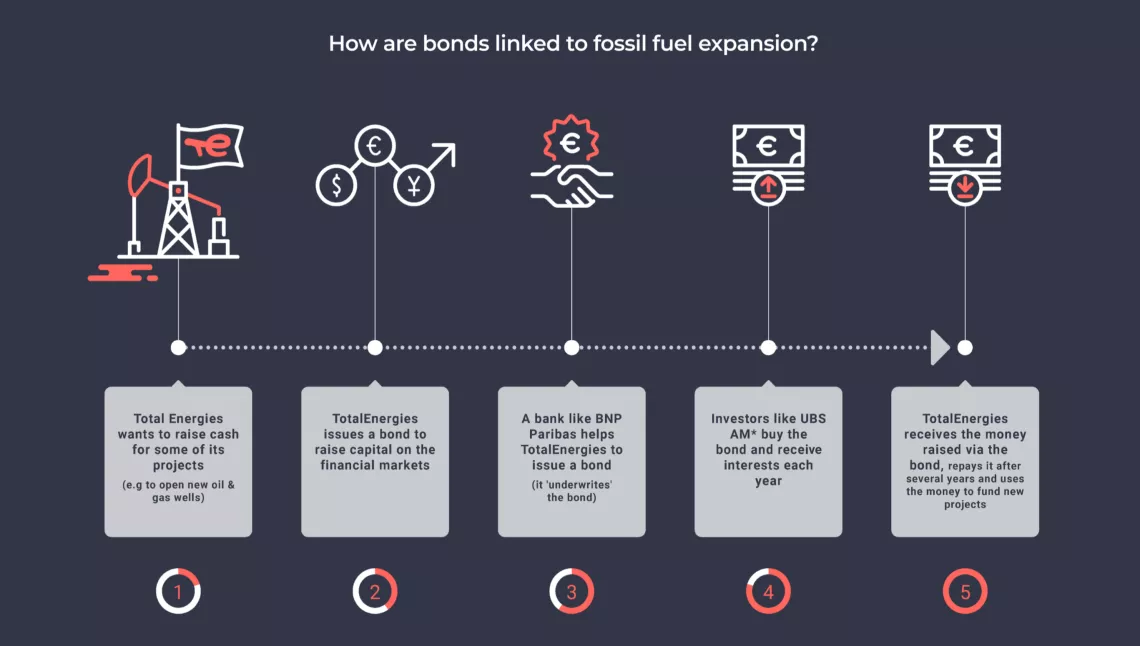

Asset managers should refuse to buy new bonds or shares issued by fossil fuel companies that have expansion plans and are not committed to aligning their business with the goals of the Paris Agreement. This new money is what companies really need in order to build new projects, and increasingly, fossil fuel companies obtain that money by issuing new bonds to global investors. For example, fossil fuel companies have recently sold bonds to help raise money for their companies while they are involved in projects like the Driftwood LNG terminal in Louisiana and the Willow oil drilling project in Alaska, both of which will be disastrous for the climate and local communities.

In addition, asset managers must also strategically use their roles as partial owners of companies and utilize their shareholder voting power to influence corporate decisions. Investors must set the right expectations for companies, and hold companies accountable when they don’t meet those expectations. This means that asset managers must set expectations for fossil fuel companies to align their business with the goals of the Paris Agreement – and hold them accountable to achieve those goals by denying them new financing and using the leverage they have to demand better.

Read the latest scorecard and join us as we call on asset managers to adopt a comprehensive climate strategy that protects our savings – and our future – by stopping the flow of new money to fossil fuel companies and using shareholder voting power to hold the biggest polluters accountable to meet our global climate goals and ensure a more prosperous future for all. Tell America's largest asset managers: Stop fueling the climate crisis!