Major banks are financing deadly coal-fired power plants in the United States thanks to loopholes in their climate commitments. That’s the latest finding of a new analysis by the Sierra Club’s Fossil-Free Finance campaign revealing that major banks from around the world — including Barclays, JP Morgan Chase, Bank of America, Citi, Wells Fargo, and Mitsubishi UFJ (MUFG) — are propping up the coal sector by financing the parent companies behind major coal utilities across America.

- Read the report: Lethal Investments: The Health Consequences of Cash Flows into Coal

- Read the press release: New report: Major global banks are financing deadly US coal plants thanks to loopholes in their climate commitments

The analysis follows the release of the Sierra Club’s Out of Control report, which revealed that soot released by US coal plants with no firm retirement plans by 2030 cause approximately 3,800 premature deaths per year. And major banks have a key role to play in this deadly pollution, thanks to the massive loopholes in their climate policies that allow them to continue to pour billions into dangerous and deadly coal power.

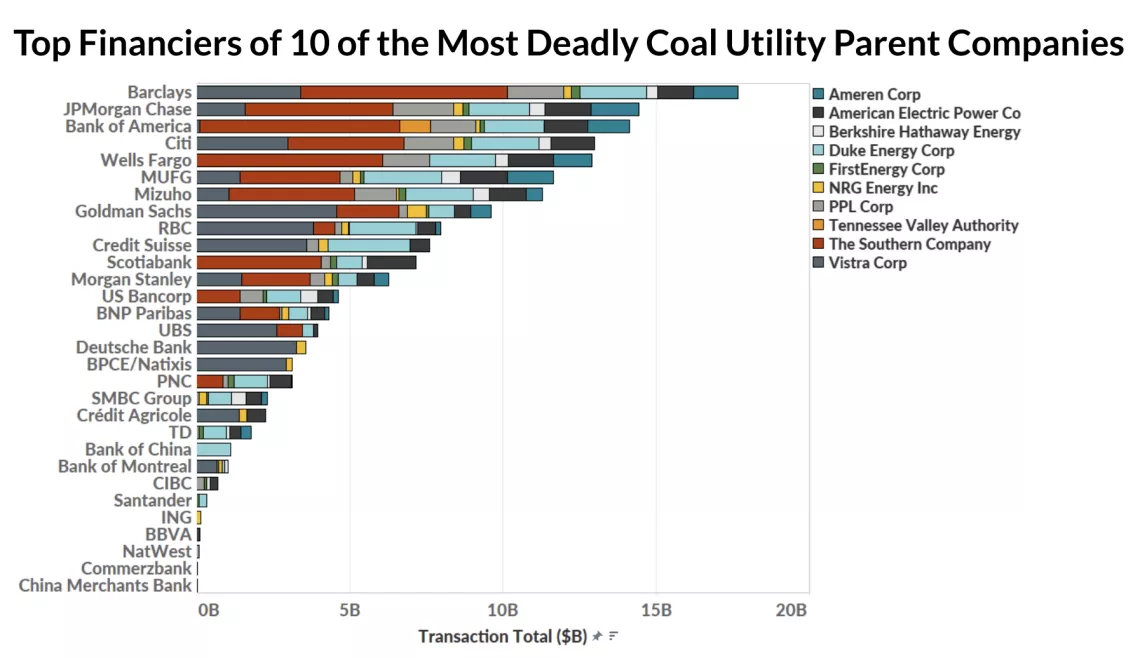

Top global financiers of 10 of the most deadly coal utility parent companies in the US from soot pollution (Berkshire Hathaway includes subsidiaries PacifiCorp and MidAmerican Energy Company). Source: Underlying financial data is from the Banking on Climate Chaos report, with the exception of the Tennessee Valley Authority underwriting deal from S&P Global Capital IQ, and the list of utility parent companies from the Out of Control report.

Top financiers

Since 2016, major banks around the world have poured $166 billion into 10 of the most deadly publicly traded and federally owned coal utility parent companies in the US: Tennessee Valley Authority (TVA), PPL Corporation, Berkshire Hathaway Energy, Ameren Corporation, Vistra Corporation, FirstEnergy Corporation, Duke Energy Corporation, NRG Energy Inc, American Electric Power, and The Southern Company. The top 6 banks make up 50%, or $83.8 billion, of the total financing.

Deadly impact

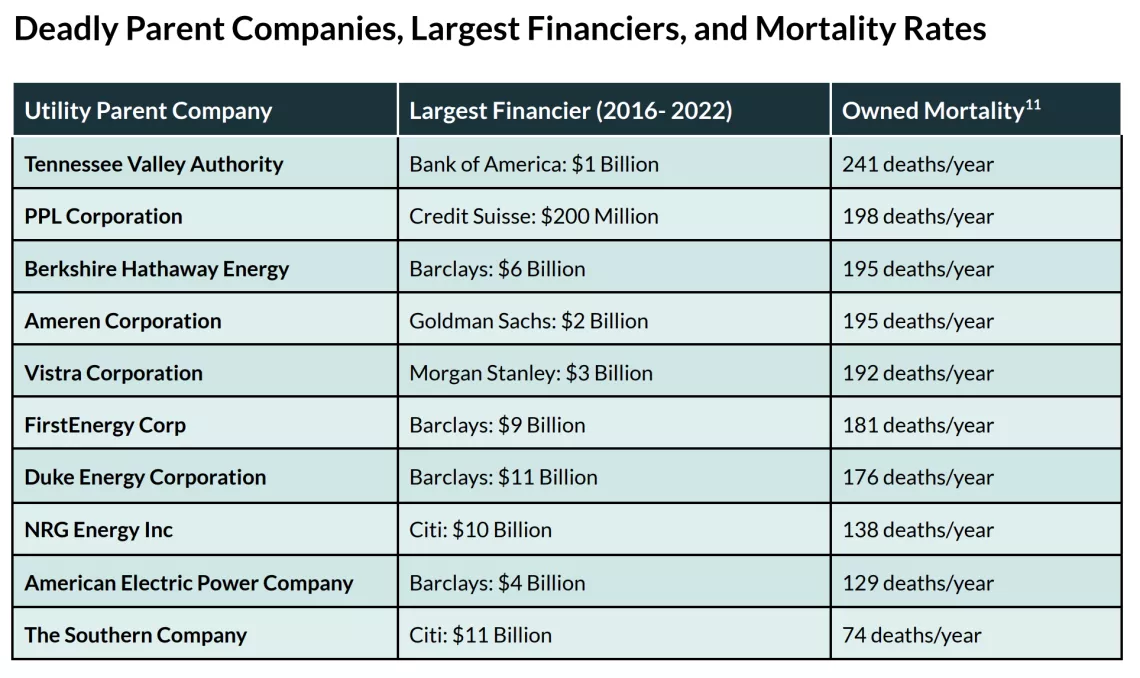

These 10 coal utility parent companies operate coal plants in 16 states with no firm plans to close by 2030. For every year these coal plants remain operational, an additional 1,719 lives will be lost from air pollution exposure.

By financing the parent companies of these coal utilities, major banks are channeling billions of dollars into the very companies responsible for keeping these deadly coal plants operational and poisoning nearby communities with toxic air pollution. By continuing to pour money into coal, these banks are telling their shareholders, clients, and regulators they aren’t serious about meeting their own climate commitments.

Largest financiers of 10 of the most deadly utility parent companies alongside their owned mortality rates for coal plants without plans to retire by 2030.

Stronger climate policies

In order for banks’ climate commitments to be effective, restrictions on project financing alone will not be sufficient, and banks must expand their policies to include restrictions for underwriting services and general purpose financing to utility companies responsible for prolonging the use of coal in the power sector.