This is a joint blog with Patricio Portillo, cross-posted with NRDC

A new independent analysis finds that past truck pollution standards did not significantly impact vehicle sales, production, or employment. This dispels more than 15 years of claims by truck manufacturers and critics that heavy-duty vehicle (HDV) emissions standards disrupt sales and lead to manufacturing job losses. These findings are timely as truck manufacturers continue to argue this point while the Environmental Protection Agency (EPA) and several states work to finalize new truck pollution standards by the end of the year.

The analysis by the respected research firm ERM is a strong counterargument to claims made by industry. The three points often cited by industry are:

-

Truck emission standards disrupt sales.

-

Disrupted truck sales cause manufacturing job losses.

-

Past behavior predicts future performance.

The report clearly addresses these claims, finding that emissions standards had no significant impact on any of the above.

Bottom line: it's a convenient argument for critics that distracts from the evidence.

STRICT TRUCK STANDARDS ARE THE BEST TOOLS TO CLEAN UP POLLUTION

Federally, EPA is on track to finalize a HDV air pollution standard that would require manufacturers to make modest improvements to new fossil fueled combustion engines, which emit dangerous amounts of harmful air pollution. The rule applies to a broad category of heavy-duty trucks and would be the first update to federal truck standards in more than 20 years. Disappointingly, the proposed standard is significantly weaker than what is technically feasible and cost effective. In part, this is because of intense truck manufacturers lobbying in which they falsely claim that strong standards impact sales and hurt jobs. Additionally, EPA postponed updating the greenhouse gas (GHG) standards until next year.

Fortunately, states are moving ahead. Nearly a dozen states have adopted or plan to adopt standards to cut new HDV nitrogen oxide (NOx) emissions by 90 percent and accelerate zero-emission truck sales, such as the Heavy-Duty Omnibus and the Advanced Clean Trucks rules.

THE PRE-BUY/LOW-BUY MYTH

Critics of clean truck standards claim that regulations increase truck prices, causing purchasers to stock up on older truck models before the regulation comes into effect (“pre-buy”), resulting in a commensurate drop in sales after the standard begins (“low-buy”). Critics further claim changing demand leads to manufacturing layoffs, suggesting that protecting public health means hurting jobs. This claim, known as a “pre-buy/low-buy” phenomenon, doesn’t hold up to the facts of the ERM report.

ERM’s report scrutinizes the “pre-buy/low-buy” claim by analyzing prior federal truck regulations to see whether they impacted employment, production, and sales. To test the thesis, ERM compared heavy duty truck sales as regulations kicked in to that of cars and light duty trucks, which didn’t have new tailpipe standards at that time. After analyzing four HDV regulations (2004, 2007, 2010, and 2014), the report found no significant impact to employment, production, or sales in any instance, and concludes there is no firm basis to claim that truck emissions standards impact sales or employment.

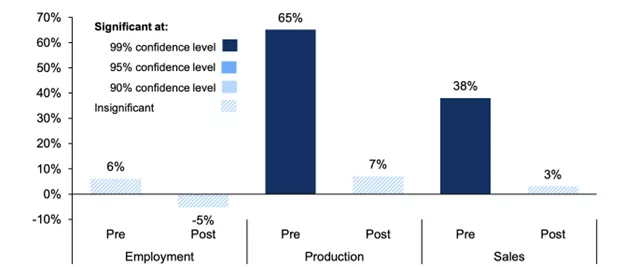

The 2007 HDV, which required large technology changes, is often cited by truck manufacturers as displaying pre-buy/low-buy patterns. However, ERM’s analysis found no significant pattern, instead determining that demand fluctuations were likely due to factors other than the regulation. As the chart below shows, if a pre-buy/low-buy phenomenon occurred, there would be a significant increase in employment, production, and sales before the regulation came into effect (“Pre”) followed by a commensurate significant decrease in employment, production, and sales once the regulation was implemented (“Post”). That did not occur.

TRUCK SALES ARE CLOSELY TIED TO THE US ECONOMY

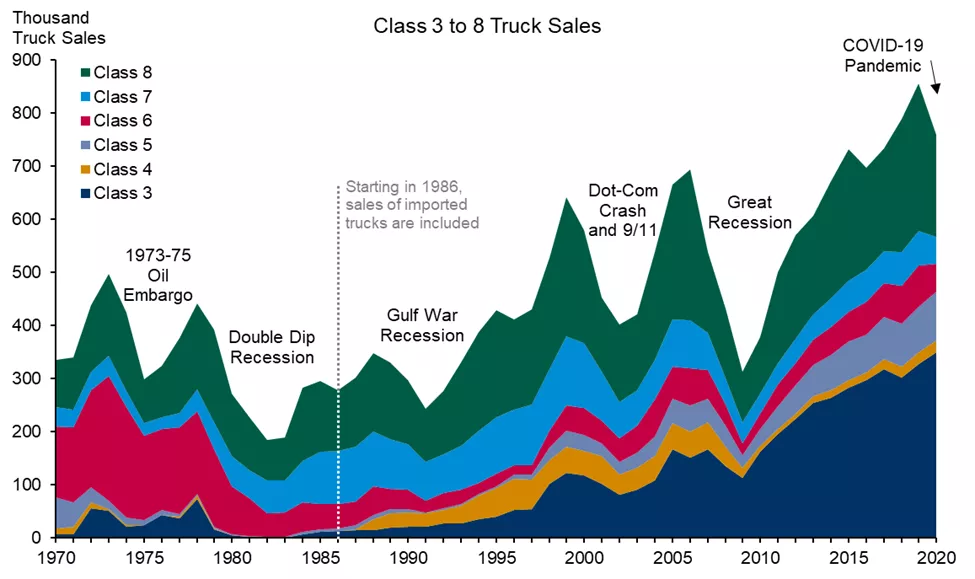

A key finding from the report is that HDV sales decline appears to be a leading indicator of recessions. This is particularly salient to the 2007 HDV standard. In 2006, economic growth had slowed and the federal reserve raised interest rates four times in an effort to control inflation. The rate hikes increased financing costs for companies, including truck purchasers. By the start of 2007, the economy was limping along at 1.3 percent growth. Then, in April of 2007, subprime mortgage lender leader New Century Financial Group filed for bankruptcy.

During years of bad economic outlook, companies reduce their spending and investments, including in capital expenditures such as trucks, well before an official recession period begins. In other words, macroeconomics drives the pace of truck sales, not regulations.

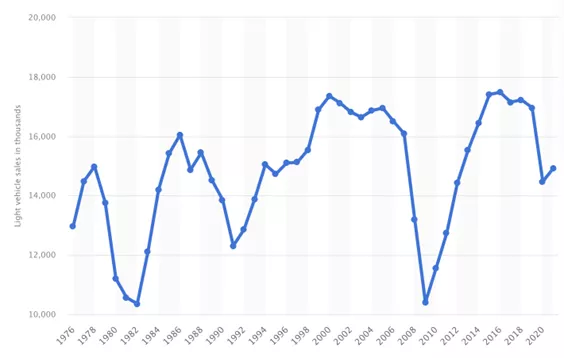

We also see that bad economic conditions impacted car sales similarly. The chart below highlights how the LDV sector experienced declining sales starting in 2006 and significantly dropped as economic conditions worsened. So, while trucks had new tailpipe emissions standards at this time, cars did not, but they both saw a similar slump in sales.

TODAY’S STANDARDS AND CIRCUMSTANCES ARE DISTINCT

Thorough HDV standards, such as California’s Heavy Duty Omnibus rule, ensure that truck emission control systems continue working as they age. This is done by extending manufacturer warranties–increasing the time truck manufacturers are responsible for their products. Aside from the immediate benefit to truck purchasers of reducing maintenance costs, it also creates a powerful incentive for truck manufacturers to design more durable products that will have fewer breaks resulting in operational downtime. Stronger truck pollution standards could actually increase demand for post-regulation trucks.

Another notable difference is the unique challenge brought on by the COVID pandemic. Ongoing supply chain challenges caused by the pandemic have hindered manufacturers ability to meet purchase orders. Consequently, medium- and heavy-duty vehicle production dropped by 10 percent in 2022. Meanwhile orders continue stacking up, so even if manufacturers return to pre-pandemic production volumes, a backlog will remain. Under these conditions, it’s unlikely truck purchasers could even execute a “pre-buy” ahead of new regulations.

TRUCK MAKERS PUSH FALSE CLAIM

As EPA and states consider HDV standards to protect public health, truck manufacturers continue to use the pre-buy/low-buy argument to reduce the stringency of these proposed regulations.

Using the pre-buy/low-buy myth as a tool to persuade policymakers is part of an ongoing trend by truck manufacturers. Lawsuits filed and then withdrawn against clean truck regulations, aggressive lobbying efforts by the Truck and Engine Manufacturers Association across the country to delay regulations, and misleading information on the state and cost of clean truck technology have become part of an arsenal of tools critics are using to prioritize status quo over public health and the environment.

With this new analysis in hand, states and the federal government must reject the pre-buy/low-buy myth and adopt the strongest possible HDV standards to protect public health and curb greenhouse gas emissions. For EPA, this means adopting a strengthened NOx rule, and for states it means moving boldly ahead of the federal government by adopting the Advanced Clean Trucks and Heavy-Duty Omnibus rules.