Today tens of thousands of American taxpayers are standing with one voice, taking on some of the largest corporations in the country and demanding that the Department of the Interior close an unintentional loophole that coal companies have taken advantage of for decades.

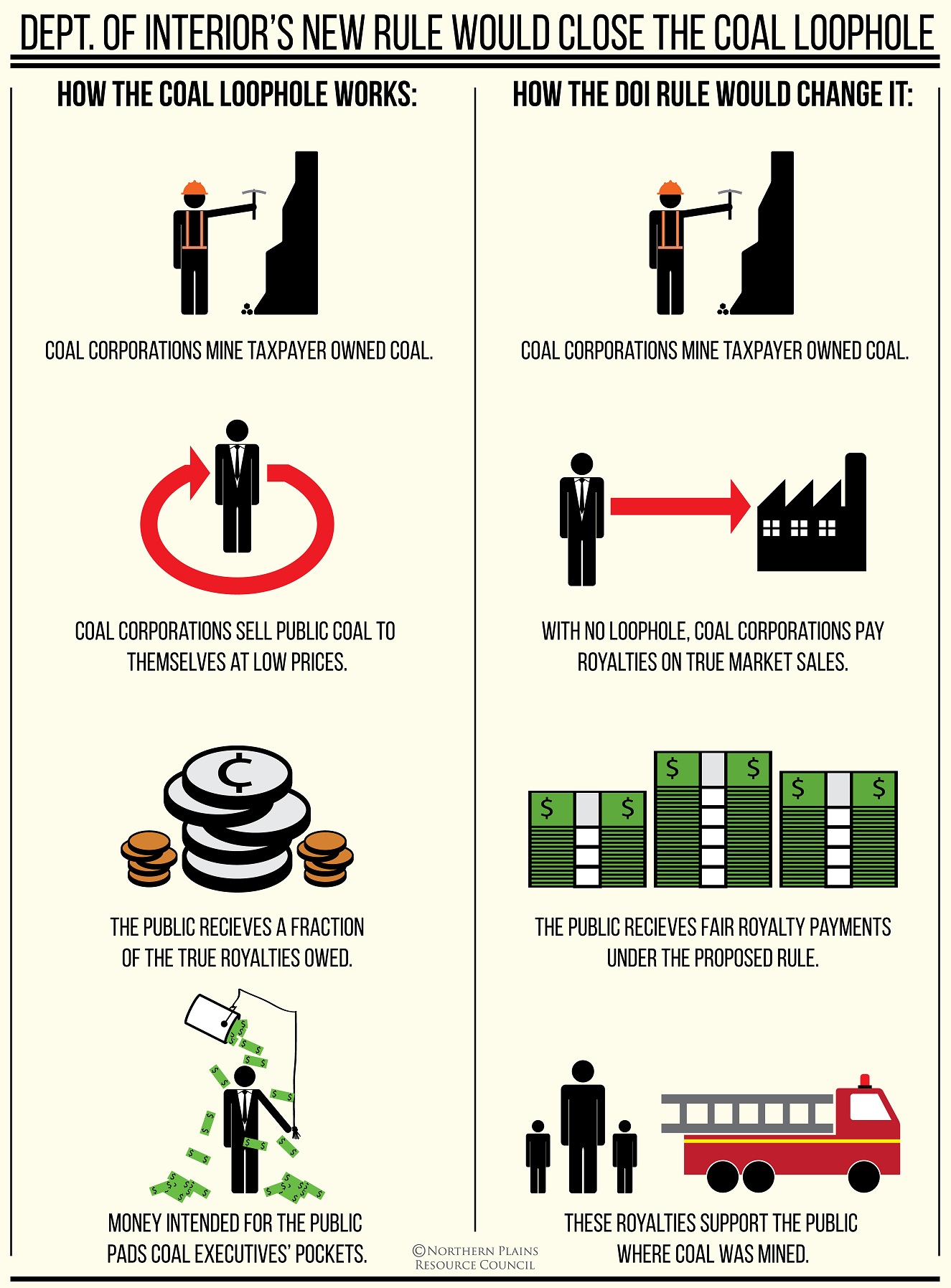

Here’s how it works: the government leases public lands to coal companies, which are required to pay part of the money they make from that taxpayer-owned coal back to the government. These payments are known as royalties. Big polluters are exploiting a loophole by selling the coal to themselves through a series of shell corporations to avoid fees -- and costing taxpayers hundreds of millions of dollars in the process. Right now, companies can sell coal to a subsidiary at a below-market rate, pay royalties on the initial sale, then reap windfall profits when the subsidiary resells the same coal on the open market, often for 10 times the price. Thanks to a Reuters investigation, we know that these “non-arm’s-length transactions” allowed coal companies to pocket an extra $40 million dollars in 2011 alone.

The good news is the Office of Natural Resources Revenue (ONRR) is trying to fix this expensive problem. Their proposed rule is good first step, but it should do more to eliminate subsidies and require coal companies to pay royalties on the true market price of all coal so the government collects a fair return for U.S. taxpayers. In our comments, the Sierra Club has called on the ONRR to strengthen the rule in three important ways:

1. ONRR is currently proposing to base royalties on the first "arm’s length" sales, but a recent study from Headwaters Economics finds that this approach “would result in little to no new revenue.” Instead, royalties should be based on the final sale to a power plant or other end-user. This would improve transparency, reduce administrative burdens, and better reflect the true value of publicly-owned coal – to the tune of roughly $139 million a year, according to Headwaters.

2. Instead of allowing coal companies to pass the full price of transporting and washing coal onto the public, these costs should be capped at 50 percent, in line with the oil and gas rules. That same study from Headwaters estimates an increase of $512 million a year in revenue from this change alone!

3. In its proposed rule, ONRR vastly understates the pervasiveness of non-arm’s-length coal sales. The final rule should reanalyze the issue to accurately reflect the benefit to taxpayers from closing the loophole.

The Sierra Club is not alone in calling for commonsense reforms that ensure taxpayers get a fair deal on publicly owned coal. Secretary Jewell agrees, and more than 51,000 citizens joined us in standing up to the coal industry during the public-comment period. Not surprisingly, a recent opinion poll conducted by Hart Research Associates found that a majority of Americans from across the ideological spectrum support closing federal subsidies to the coal industry for coal mined on public lands -- and by more than a two-to-one ratio.

Not only is the federal coal leasing program woefully out of date, it is also dramatically out of step with the president’s commitment to fighting climate disruption. Keeping these dirty fuels in the ground is critical to safeguarding our climate, meeting international climate commitments, and achieving carbon emission reductions put forward in President Obama’s Climate Action Plan.

Earlier this month, Secretary of the Interior Sally Jewell openly questioned whether the program she manages is in line with our country’s climate change objectives and declared it is “time for an honest and open conversation” about the federal government’s coal leasing practices. We look forward to having that discussion, and closing the coal royalty loophole is the right place to start.

-- by Marni Salmon, Lands Protection Campaign; infographic courtesy Northern Plains Resource Council