Yes, Reversing the Climate Crisis Can Be Profitable

Investor Ibrahim AlHusseini talks clean energy initiatives

Ibrahim AlHusseini, the founder and CEO of the investment firm FullCycle, which aims to scout and back those companies most likely to solve the climate crisis, never thought his career would take an environmental turn. The Palestinian American businessman—an early investor in Tesla and Uber—grew up as a refugee in Saudi Arabia. But after coming to the United States for college and realizing he had a knack for entrepreneurship, he found himself increasingly alarmed whenever he’d travel back home to visit his parents. “Saudi Arabia was a fast-deteriorating desert—full of dusty palm trees and locusts, whereas in the '80s it was super lush,” AlHusseini told Sierra. “I’d go scuba diving in the same spot year after year—that spot, too, over time went from lush, colorful, rich, and inspiring to barren, full of plastic, and devoid of life. It really woke me up.”

He got to thinking, What’s the point of accumulating wealth if the things I care most about are fading away from the planet? “I wasn’t a politician or activist, but I knew how to build businesses, and I knew how to invest,” says AlHusseini, who in 2003 decided to take a year off and study climate science. “When I went back to work, I decided that since the decisions that were made 30 years prior had resulted in the world I was then living in, I would make investment decisions that’ll impact the world 30 years from now, based on my understanding of what the world needs—which is largely based on IPCC [UN Intergovernmental Panel on Climate Change] reports.”

Sierra recently sat down with AlHusseini (a new friend of Jane Fonda’s!) to learn more about the clean-tech ventures he finds most promising, the private sector’s potential in reversing the planetary crisis, and why the immigration issue is really a climate issue.

***

Sierra: Tell us about your inspiration for launching FullCycle in 2013.

Ibrahim AlHusseini: Growing up in the '80s as a Palestinian refugee in Saudi Arabia, I felt very unsafe geopolitically, and the idea of having a little power and respect in the world was very appealing. Most people don’t realize how ubiquitous American media is—I grew up watching Miami Vice, Dallas, Dynasty, and Lifestyles of the Rich and Famous. As a child, I was kind of indoctrinated in the idea that if you want to be validated/respected, that somehow is correlated with your net worth. So that was my “goal,” and it was only after moving to the US that I realized our modern world is built on systems. And many current structures were built at a time when we thought the world was infinite—it’s why we’ve been extracting old fossil fuels and cutting down trees, why we ended up with a generation that has to reconcile that: ours. So how do we quickly replace old, crummy infrastructure with new infrastructure that was designed in the 21st century, by scientists who understand we live on a finite planet with finite resources? And how do we make it profitable? Those are the questions that brought my entrepreneurial investment journey into the realm of climate.

What kinds of companies and technologies are you most excited about right now?

Tech that turns waste back into the elements that we can turn back into whatever the market needs. I’m excited about Synova Power, which breaks down hydrocarbons to their component elements, so you can recombine them to create almost anything you want—you can create virgin plastic out of plastic and not use fossil fuels, so there’s no more downcycling. There are also opportunities to turn component elements into biofuels, or into renewable natural gas. The point is that you’re getting the efficiency of turning something that the world is currently burying in the ground or throwing into the ocean into a valuable resource that can perpetually be part of a closed-loop system that’s taking us closer to a sustainable society.

You know and I know that sometimes we use the word “we” and that “we” is not really the encompassing we—Malaysia has no idea about any of these narratives we’re considering, nor do India and Indonesia and almost the whole continent of Africa. So we have to work for the “overall we” and not just for the “rich progressive bubble we”—and that’s what I like again about this technology: It makes modern civilization less burdensome on the planet without trying to elevate the behavior of 11 billion people. Because the best that you and I can do as conscious, aware individuals is to have a lower carbon footprint—by our existence, we won’t be carbon neutral, but we can reconcile that by making sure that modern civilization itself gets closer to carbon neutral.

There are also exciting probiotic mixtures that you can put into irrigation systems that make plant immune systems so much stronger, so they need 60 percent less herbicides and fungicides. It makes the soil sequester way more carbon without any big fancy technology. Using natural soil remediation in a natural mixture of probiotics.

What are the advantages of coming at these issues from the private sector, rather than from a policy standpoint?

You’re making choices that are based on economic sustainability as well, so we can look at things for both carbon math and financial math, and only do things that work for both. We’re not going to get the traction and scale we want if things are not profitable—we have to make it more profitable to reverse the climate crisis, so that investors are not giving us tiny little amounts of their portfolio but rather big ones. You also don’t have to have ideological debates in this space, because no one can deny that we need more fruits and veggies, or that waste management is not a net positive. It’s a conversation that makes a lot of sense, and I always emphasize that technology inflection points are massive wealth opportunities—whether we’re going from horse-and-buggy to car, or from paper to digital, or from a high-carbon to a low-carbon economy. It’s not just a nice-to-have; we’re talking about the sustainability of life itself on the only home that we know. But who are the people who are going to benefit financially from that transition? It’s amazing how amicable people are once dollar signs are involved.

Can you talk more about the return potential when it comes to climate-smart tech?

First, I want to make one important distinction, given the venture capital mindset in urban California—it’s too late for venture! The climate has no timeline for venture; we’re already there. And remember, low-carbon infrastructure isn’t an app; we’re talking about a power plan! This is very complex hardware that is going to need to be built on a municipal scale—in order for that to go from a lab to a pilot to demonstration to being commercially viable, we’re talking about 12 years. So FullCycle only focuses on market-ready stuff—we’re here to accelerate the deployment of market-ready tech.

Climate is a race against time! How quickly can we transform our relationship to waste worldwide? Take waste management—it starts with closing landfills, because if we can turn garbage into money, no one throws money away! We’re here to quickly condense the business plans of all these climate-smart technologies so they can replace existing systems. We’re not VC; we’re a private equity firm investing in sustainable infrastructure. We back companies so they can build on RFPs [requests for proposals] quickly so they have the financing ready to go once they win those RFPs. That way instead of having, like, eight clean waste management plants by year five, they have 48 plants by year five—and hopefully 850 by year 12, and then by year 20, they have 5,500 plants all over the world, and in our lifetime, we’ve transformed our relationship to waste, and we’re saying things like, “Can you believe people used to throw things away and it’d end up in whale stomachs.”

Where do you project we’ll see the most growth in the clean energy sector?

The technologies that have to explode are in agricultural tech—it’s one of the biggest carbon-contributing industries. As we knew would happen, the electrification of transportation is upon us; it’s happening. We just have to make sure we create better infrastructure—make sure there’s more places for us to plug in our cars—so people cannot have that range anxiety. And of course, the more autonomous vehicles there are, the less people need to own cars. Waste is a huge one, too, especially because waste breaks down into methane and short-lived climate pollutants like HFCs (which are refrigerants) that are far more heat-trapping than CO2. We have to focus on those initially—and because the supermarket doesn’t have an incentive to fix those leaks, we need a new business model there.

What should consumers expect of businesses in the age of climate change, and what’s a sign that a business is truly going above and beyond to address the climate crisis?

First of all, there’s not enough time left for the Trump administration to lull businesses into thinking that all of the regulation reversals are going to show up in their bottom lines, and not enough time to take advantage of that before we correct it. Look at big car companies—even though Trump is trying to fight California in federal court, getting them to roll back their mileage emissions regulations, a lot of companies are saying, “Listen, we’re not going to play along,” because they’re smart enough to know that this is an anomaly, not the standard. So my advice to businesses is, don’t change the trajectory of your business based on a year-and-a-half-left administration. And stop pretending you’re an eco-hero for some kind of incremental behavior—it’s way too late for incrementalism; the house is on fire.

Speaking of the Trump administration, you’ve been a vocal critic of its immigration policies. A lot of self-proclaimed environmentalists are anti-immigration; can you talk about immigration’s connection to the climate crisis?

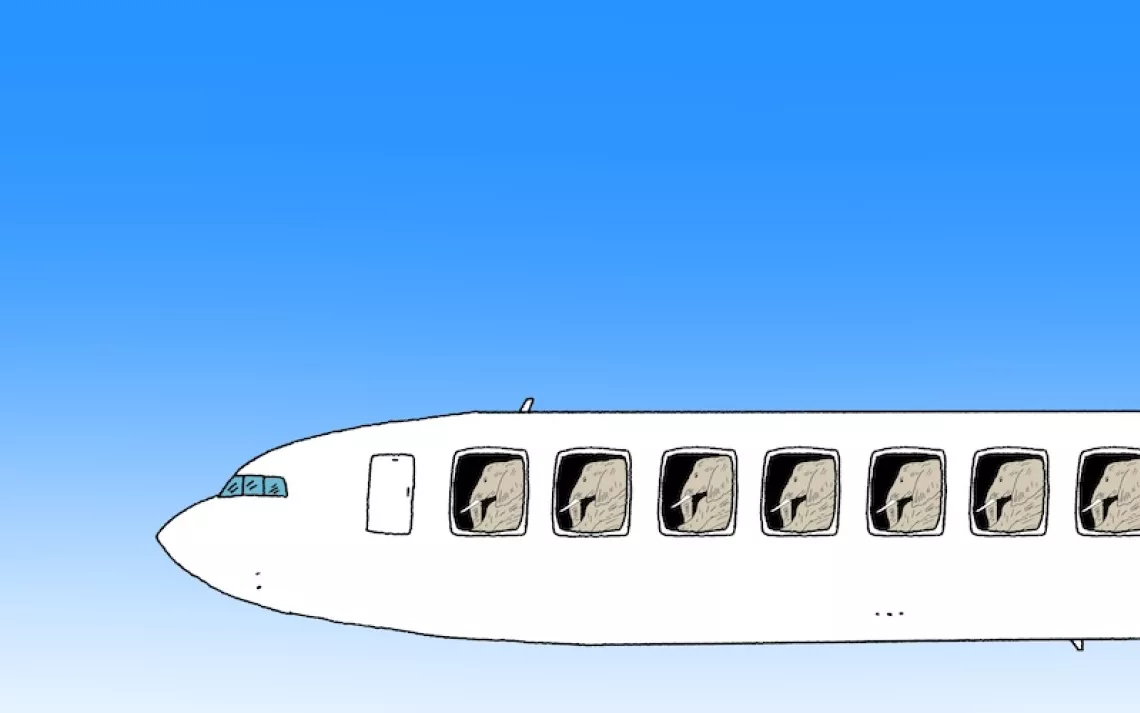

Forty percent of the world’s population lives in the subtropics—and if you look at climate models, the subtropics are all going to have permanent droughts. It’ll be virtually impossible to grow food there, and these are poor countries—they won’t be able to make up for it. Either they’ll starve to death or migrate north. And when you have billions of people who need to migrate north, a steel barrier is not going to stop them. And you know who’s going to break down that steel barrier? There are going to be enough people in America and Europe who are not going to let children starve to death and pretend this is not happening. We are going to break down that barrier from our end to let them in. Your only pragmatic solution is to keep nations stable by investing in clean infrastructure in their countries.

Immigrants are painted as these pariahs who are here to suck on the resources of wealthier, more developed nations. But I can speak for myself and the fellow immigrants I know—we come from nations that do not have rule of law, that have dictatorships, that are not a meritocracy, that don’t provide a system where anybody can be rewarded according to the degree that they’re willing to work and think and contribute—and that contrast actually gives us a true appreciation of America.

The Magazine of The Sierra Club

The Magazine of The Sierra Club