Paul Dale, Energy Committee Chair

The proposed peaker power plant in Peabody, Project 2015A, is wrong on many levels. This comes into focus by looking at the realities behind the three justifications put forward as reasons for building the plant: adding capacity for times of peak electricity usage, capacity for extreme events when gas supply is constrained, and as a way for MLPs to save money.

Daily Summer Peaks

The first justification is associated with the word “peaker” implying that the purpose is to provide power at times of peak electricity usage when other generation is not adequate[1]. Peaker plants can startup quickly when need arises but because they supply power only occasionally, the power supplied commands a much higher price per kilowatt hour than baseload power. Their purpose is to provide reliability but there is a significant ratepayer cost for this.

Currently, the highest daily peaks occur on hot summer afternoons when the demand for air conditioning is high. (There is no demand for heating so gas supply is not a concern.)

Ratepayers should not be forced to pay the high cost of building a new and infrequently used plant to service just the few high demand hours in summer. Moreover, there is a significant cost to maintain and guarantee that a seldom used plant will actually be available when needed, which is contrary to affordable power goals.

Justifying the plant on the basis of reliability for hot summer afternoons would not be persuasive. Today, there are many options and other approaches. For completeness, some of the other options and realities are presented below, but be aware that using gas to help meet daily summer peaks is not the real justification for the plant. There is more to come later in this paper.

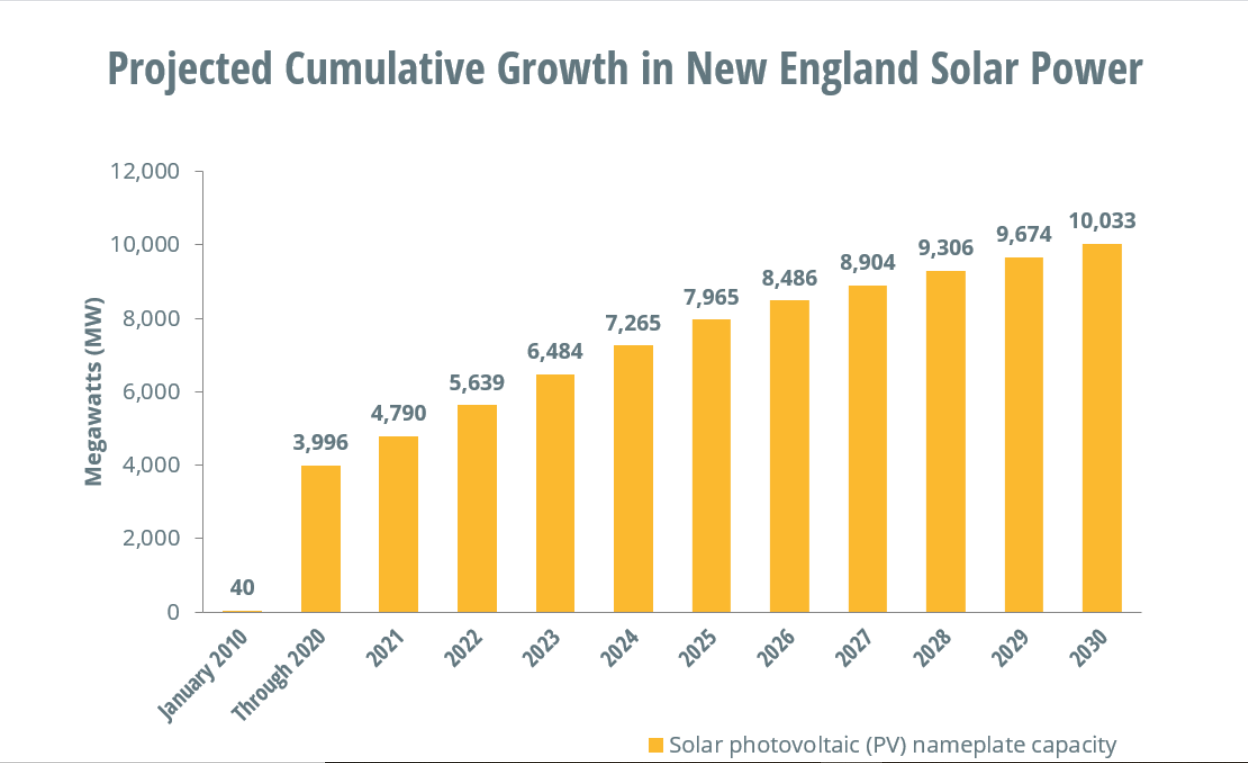

Solar Plays a Key Role. The EEA Interim 2030 Clean Energy and Climate Plan (CECP)[2] observes that, “Solar resources represent a key complementary resource, reaching optimal production during the day and summer compared to offshore wind’s peak production at night and in the winter.” ISO-NE has documented[3] that, “Regional Solar Power Reduces Demand from the Grid” and that, “Solar Power Is Changing Historical Grid Demand Patterns” stating, for example, that “During a heatwave in July 2018, BTM[4] solar generation peaked each day at around 1:00 p.m., reducing demand from the regional power system by approximately 2,000 MW.” This reduction in the peak is a much greater impact than the proposed 55 MW plant would offer and was back in 2018 when the amount of solar was less than today and much less than ISO-NE projects will be present in the future:

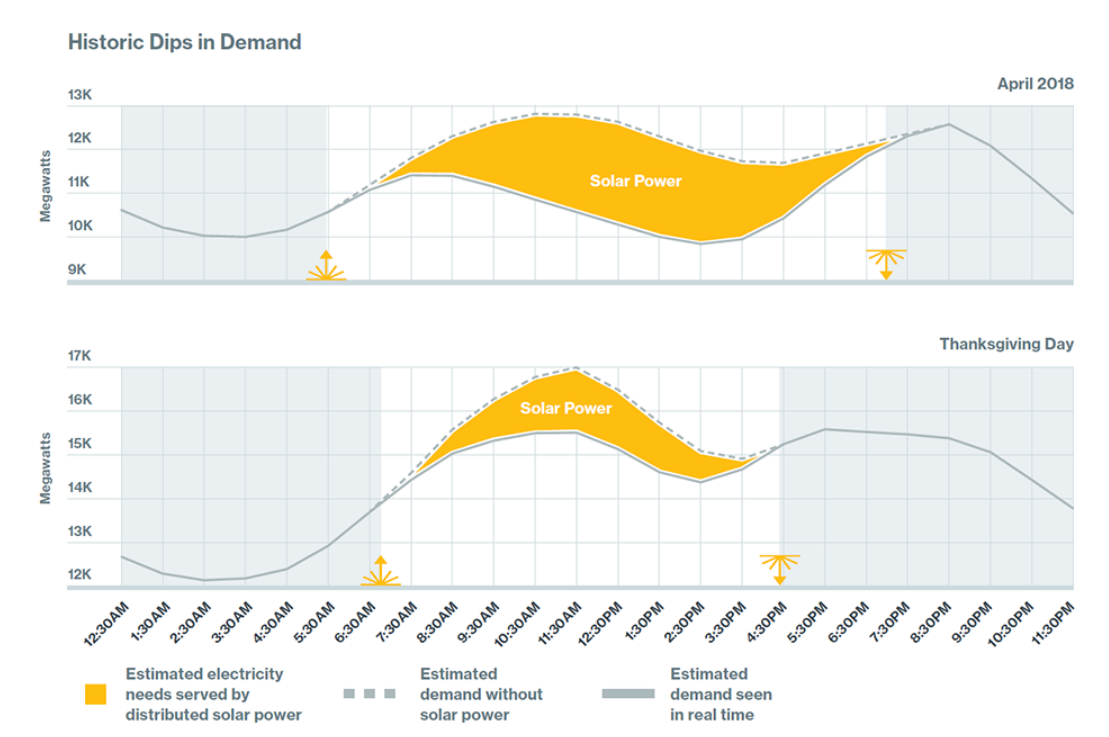

ISO-NE has already seen days when the existing solar generation has reduced expected daily peak demand below nighttime actual usage:

Battery Storage Is Relevant. Massachusetts Municipal Wholesale Electric Company (MMWEC) CEO Ronald DeCurzio in his Commonwealth Magazine article[5] of June 1, 2021 observes that “the sun doesn’t always shine and the wind doesn’t always blow”. But the summer peaks where extra attention must be paid to capacity to ensure reliability are the peaks that only occur when the sun is actually shining. Solar not only substantially reduces the magnitude of the peak, it also shifts the (reduced) peak to later in the day or evening when solar generation falls off. Battery storage has role to play by providing reserve power to cover the lesser but shifted later-in-the-day peak.

Distributed Solar Has Inherent Reliability. Solar has inherent reliability because there is no single point of failure – our solar resources are widely distributed with multiple points of grid connection. Investing in solar provides greater reliability than investing in a centralized plant.

Demand Response Can Be Important. The cost of electricity rises significantly when the most expensive, least used generators, such as the proposed plant, need to be brought online. Already there are options for residents and businesses to be rewarded for participating in demand response, and more options will surely come. For example, Eversource has a demand response program for businesses[6], the ConnectedSolutions Demand Response for residents with battery storage[7], and an EV Home Charger Demand Response incentive[8]. MLPs have the option of implementing demand response programs and/or time-of-use rates and metering.

Conservation and Efficiency Can Be Important. The most cost effective electricity is that which ratepayers never use – because their homes are efficient, because they control the amount of air conditioning used, because they air dry their clothes, etc.

Summer Summary. The net result is the conclusion that there is no justification for building additional gas infrastructure to meet summer peaks. There is no justification for adding emissions when the alternatives above have no emissions. There is no justification for the cost of a plant that is very expensive to build and run and will inevitably become a stranded asset as renewables and storage expand.

But what about the winter? Therein lies the justification that most animates Ronald DeCurzio’s Commonwealth Magazine essay.

Multi-Day Fuel Scarcity

ISO-NE has identified that fuel-security risk — the possibility that power plants won’t have or be able to get the fuel they need to run in winter— is the foremost challenge to a reliable power grid in New England – the “polar vortex problem”. It is a multi-day concern with very cold winter weather. The fuel security concern arises because there is a fixed pipeline supply of gas at a time of simultaneous demand for gas for heating and for electricity generation, and heating customers have top priority for use of the available gas.

This ISO-NE concern is a justification that Ronald DeCurzio puts forth for the proposed plant. He asserts that, “The proposed plant is expected to run … only … during times of system stress, such as during extreme weather.” He begins his article by comparing our risk with Texas by asserting the plant “is needed to prevent an energy crisis like the one that occurred in February in Texas, when the power went out for an extended period.”

For the record, the reason Texas experienced a disaster is because they did not invest in the measures needed to keep gas power plants and wind turbines operating in cold weather. There is no comparison with the risks in New England where our generation is fully prepared for cold weather. But ignoring Texas, is there a valid justification based on addressing ISO-NE’s concern with fuel scarcity?

It’s an Oil Plant. A gas fueled peaker plant has no role in alleviating fuel scarcity centered on limited gas supply. That is the reason the proposed plant includes a 200,000 gallon oil tank. The plant can also burn oil. The winter events that would cause it to run, when gas is constrained, means that oil would be burned, not gas. Furthermore, fast start up time, while part of the engineering design, is not a requirement because the onset of cold weather events are known in advance. This plant’s intended use is not as a gas peaker; it is a backup oil plant.

The Smell of Ammonia. In addition to oil storage ammonia storage has been proposed for the plant. There is evolving research on using ammonia (NH3) as a fuel because doing so emits no carbon. But commercial reality of this potential is a long way off. Mitsubishi Power appears to be on the leading edge: “Mitsubishi Power is developing a 40-MW class gas turbine that can directly combust 100% ammonia. On March 1 [2021 it said] it is targeting commercialization of the novel ammonia-capable gas turbine, … “in or around” 2025”[9]. But such a turbine is not available for Peabody.

Even if there is a turbine that could burn a blend of ammonia and gas, burning any amount of gas[10] is not a viable way to address adding power to the grid when gas is not available, and there is a huge environmental problem. Today, the only economic way to produce ammonia is from natural gas. Any claim that ammonia is a clean fuel is not legitimate.

Ammonia can be produced by electrolysis, however, “A competitive price for electrochemically produced [“green ammonia”], i.e. CO2 neutral NH3 versus conventional natural gas based produced NH3 (300-350 EUR/ton) can be achieved [only] when investment costs for electrolysers drastically come down, when costs for emitting CO2 increase significantly and when there is sufficient supply of relatively cheap CO2 free electricity. The high investments in electrolysers require a large onstream time to minimize costs per ton. This contradicts with the intermittency of large scale availability of renewable energy due to the production patterns of wind and solar.”[11]

In summary, the proposed ammonia storage is there to make the plant look as though it might have a clean future, but that future is a long, long way from viable economic reality, and will be overtaken by offshore wind and battery storage development.

Green Hydrogen Instead of Ammonia? At MMWEC’s public hearing presentation[12] on June 22nd, the idea of using stored “green” hydrogen as a possible future fuel seems to have replaced the proposed ammonia storage. See slides 33 and 34 of the presentation. This proposal has the same fundamental problems, not yet solved, as with ammonia, and introduces additional safety risks associated with transport and storage of hydrogen.

First, commercial turbines to burn hydrogen are a long way off. Mitsubishi Power is leading the way, but observes that, “Japan’s Basic Hydrogen Strategy includes the target of commercialization of hydrogen power generation by 2030. However, is it possible to commercialize hydrogen power generation in a little over ten years? Even if technology is successfully developed, how many power plant operators can afford to renew their facilities?”[13]. Just getting a gas/hydrogen fuel mix to work is difficult. “In the case of a 20% hydrogen fuel mix, the existing gas turbine can be used,” said Satoshi Tanimura of Mitsubishi Power. “However, making it usable with 30% hydrogen poses quite a challenge for the gas turbine engineer”. Obstacles standing in the way of a 30% hydrogen mix are flashback, combustion pressure fluctuation, and NOx[14]. A 30% mix “offers a reduction of about 10% in CO2 emissions compared with GTCC.”[15]

Second, the commercial processes that are used today to make hydrogen for industry are based on gasification of coal or lignite or steam methane. Green hydrogen is based on using renewable electricity to power electrolysis of water. Big electrolyzers are in short supply, and plentiful supplies of renewable energy still come at a significant price. Electrolysis is very expensive.

Finally, “storing and transporting the highly flammable gas is not easy; it takes up a lot of space and has a habit of making steel pipes and welds brittle and prone to failure. Pressurizing the gas, or cooling it to a liquid are energy-intensive and would further dent green hydrogen’s efficiency.”[16]

In spite of the difficulties and economic barriers, there is rightfully significant interest in green stored fuels such as ammonia or hydrogen for applications which cannot be decarbonized in any other way, such as maritime shipping and air travel. However, for electricity generation capacity in New England there is no reason to commit or justify a $85 million plant today in hopes of a speculative fuel source that is at least 10 years away from commercial, economic reality. After all, we are the ‘Saudia Arabia of offshore wind’…

Offshore Wind Alleviates Concern with Gas Supply. New England is blessed with huge offshore wind potential. Wind generation is intermittent; the wind does not always blow, particularly in the summer and fall, but fortunately, it is highly reliable exactly when we need it most – during cold or extreme weather events.

Question to the 83C offshore wind bidders on March 16, 2018[17]: Have any of you looked at what the impact of a 400 or 800 MW offshore generation would have been during the cold snap that we just went through? What kind of oil consumption and cost might we have saved?

- Lars Pedersen, CEO of Vineyard Wind, responded by quoting results from a Daymark Energy Advisors study[18] of the 96-hour “bomb cyclone” period from Jan. 4 through Jan 7: A proposed 800 MW wind farm would have reduced wholesale electric prices by nearly $20 per MWh and saved New England customers $31 million ($15 million in Massachusetts) during those 4 days. The reductions in CO2 emissions would have been the equivalent of removing 14,358 cars from the road for a year. Lars said, “I think there will be a new conversation about offshore wind when we see the prices here. It is a different animal. It has more baseload like capabilities.”

- Matt Morrissey, VP for Deepwater Wind responded: I can say from a Deepwater standpoint we modeled our turbines that are out there spinning now [off Block Island]. We modeled to 800 MW and we modeled to 200 and 400 and we found results similar to what your study found. The net capacity factor of our turbines during that period was just off the charts. Usually when you have intense weather conditions that’s when our turbines are producing at greatest capacity so you have this wonderful match and as a result your benefits to the market increase substantially as well.

As part of a larger project, researchers at the University of Delaware[19] have collected and analyzed hourly wind data spanning multiple years from offshore wind buoys maintained by NOAA. One of these is located near Martha’s Vineyard and Nantucket. The statistics for this buoy over a 3.8 year period are:

| Mean speed at 80m hub height | Standard deviation | Percent active (calculated by counting hours for which speed > 6.7 MPH[20]) |

| 23.9 MPH | 11 MPH | 95% |

Offshore wind was available 95% of the time in winter. By comparison, the availability of fossil fuel generators is typically 94% due to maintenance and unplanned shutdowns[21].

High winds are not a problem. Some have expressed a concern that if the wind is too strong the turbines can’t run. At more than 62 MPH the turbine will shut down. However, the data shows that the probability of this happening during the winter is essentially zero.

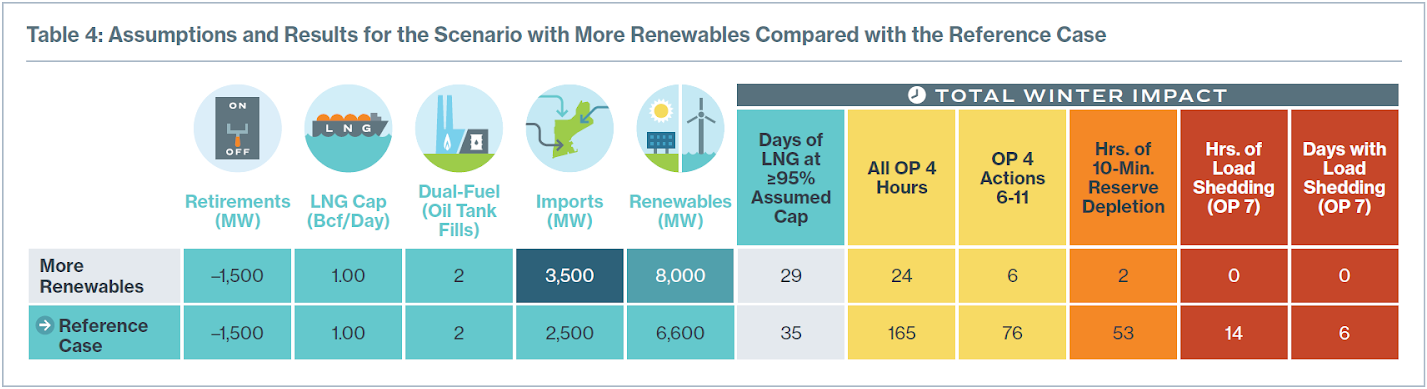

The ISO-NE sensitivity charts indicate that the reliability of every scenario would be improved by assuming more onshore or offshore wind[22]. As a particular example, “no load shedding (see the last two columns below) was required for the positive, single-variable scenario that increased renewables[23] to 8,000 MW and imports to 3,500 MW (to represent an additional 1,000 MW of clean energy [Canadian hydro] over a new transmission tie to a neighboring system).”

`

`

Solar Helps. Finally, solar further reduces the possibility of load shedding if there ever is a situation where generation need is met with stored gas or oil; every KWh generated via a solar panel or wind turbine reduces the demand for pipeline gas and reduces the drain on stored fuel supplies when gas supply is constrained. In particular, ISO-NE points out that although “solar energy can’t help directly with the winter peak . . . because demand peaks after the sun has set” solar still helps with fuel security because “solar panels can reduce the consumption of natural gas and oil during sunny winter days, so more [stored] oil and gas are available later to generate electricity to meet the daily winter peak demand.”[24] All renewables assist in adding fuel security and reliability to the grid in the winter.

Winter Wind Summary. Offshore wind (and solar) remove or significantly mitigate the fuel security concern arising from our gas pipelines. We have new zero emission “fuels” that are constrained only by our willingness to tap into them. There is no justification for the cost of a plant that is very expensive to build and run and will inevitably become a stranded asset as offshore wind and solar expand. MMWEC should be encouraged to enter into composite contracts for offshore wind for its member MLPs. In that way MMWEC could provide a real service for its members.

Winter Peaks Are Our Future

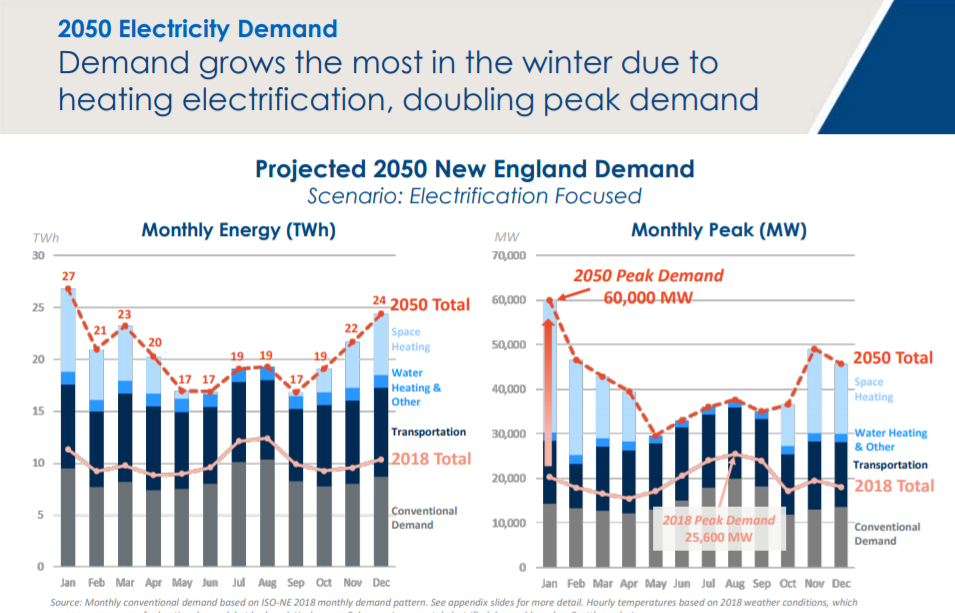

In the future the peak demand will shift from summer days to the winter days as a result of the transition to electrified heating. The 2030 Interim CECP observes that, “To achieve the 2030 emissions limit [which at the time written was 45% reduction but by law is now at least 50%] and position the Commonwealth to be on a viable pathway to Net Zero in 2050, [will] require very significant reductions from buildings using high-emitting petroleum-based heating fuels: fuel oil and propane.”[25]

The CECP sets a goal of, “Electric space heating deployed across approximately one million households and 300-400 million square feet of commercial real estate”. [This might increase as the requirement is now at least 50% emissions reductions by 2030.]

The Brattle Group in their report, “Achieving 80% GHG Reduction in New England by 2050”[26] indicates that peak demand will occur in January:

This adds to the emphasis that we must place on offshore wind. We will never meet the peaks of the future with stored oil (or ammonia or hydrogen).

Is the Plant a Plan to Save Money?

A major portion of MMWEC’s public hearing presentation[27] on June 22nd was devoted to a justification for the plant that had not previously been made clear to the public: The premise that spending $85 million to build the plant would save money for the MLPs and their ratepayers. While it is hard to know for certain, this may be MMWEC’s primary goal, more so than emissions reduction, public health, safety risks or other concerns.

Saving money is a laudable goal, but even ignoring the social cost of carbon, the costs to public health or the potential cost of accidents, will an $85 million investment now result in a savings for the MLPs? The answer appears be a solid ‘No’ for the reasons discussed below. The plant might possibly make economic sense 10 years from now, but certainly not today.

Ten Years Too Soon. MMWEC’s presentation states that the fixed annual cost of the plant would be $4,650,970 but by participating in the ISO-NE Forward Capacity Market (FCM) auctions the plant would generate revenue to partially or more than offset this cost. Slide 17 is key. It shows that for the next 10 to 12 years the auction prices are expected to be low, meaning that the MLPs would actually come out ahead if they bought all of their required capacity at the FCM auctions. It is only at about 2032 that the projected FCM auction prices are expected increase so that the MLPs would begin saving money by having the plant to meet some of their capacity obligations.

MMWEC believes the projections are reliable which should strongly motivate MMWEC to delay construction for a decade, and avoid committing capital too soon.

Furthermore, the plant should not be built now because the desired fuel, green hydrogen or ammonia, is not economically available. MMWEC should wait until an economic supply is certain, and the required turbines are available. By waiting MMWEC will have concrete information about the technology advances, costs and viability of green fuels and avoid having to retool an out-of-date plant.

The Future of the FCM Is Unclear. In October 2020 the governors of five New England states, including Massachusetts, sent a letter to ISO-NE demanding major reforms[28] stating, “The gap between our current system and the system we need to achieve deep decarbonization is marked. Today’s wholesale electricity market and organizational structures: (1) are based on a market design that is misaligned with our States’ clean energy mandates and thereby fails to recognize the full value of our States’ ratepayer funded investments in clean energy resources; (2) lack a proactive transmission planning approach … and (3) are based on a governance structure that is not transparent to the states and customers it serves, with a mission that is not responsive to States’ legal mandates and policy priorities.”

Reforms are under discussion. This process is expected to take several years, will involve FERC and its outcomes are hard to predict. The operation of the FCM is very much a reform issue. UtilityDrive has a recent (June 7, 2021) discussion[29]. The subject matter is very technical; just a few quotes are given here to provide some flavor: “Tensions between the regional operator and state officials in recent years — specifically, rules set in 2018 [known as Competitive Auctions with Sponsored Policy Resources (CASPR)] to reform its capacity auction by splitting it in two. Under the first auction, the minimum offer price rule (MOPR) would apply, effectively raising the bidding price of all state-subsidized resources. The second auction is an attempt to somewhat rectify this by allowing cleared resources to substitute themselves out for newer, state sponsored resources, and get paid for doing so.” “CASPR has been a complete failure” – Richard Glick, FERC Chair

The forecast of FCM clearing prices on slide 17 is from Standard & Poors, which produces an annual forecast in November in preparation for the annual auction. DeCurzio said that it is quite accurate and that the spike in 2046 is caused by shutting down a nuclear plant. However it is unclear whether or not and to what degree Standard & Poors anticipates ISO-NE reforms over the next 4 to 5 years - reforms that could significantly impact the FCM auctions, or introduce a new mechanism entirely.

MMWEC should not build the plant until the future of the FCM or its replacement is certain. To build it now might be just a waste of $85 million, a continuing cost burden to the MLPs, and an unnecessary risk.

Conclusion

Building a new fossil-fuel based plant at this time is not in the interest of the MLPs, their ratepayers, the state’s recently enacted climate roadmap law, the residents of Massachusetts generally and specifically those near the site.

The projections shown by MMWEC show no savings for the MLPs for 10+ years and moreover the future of the FCM for fossil fuel-based plants is unknown. The timeline for economically viable green fuels is unknown. The extent of the need for stored-fuel capacity for multi-day extreme events is unknown given the high winter time reliability of offshore wind.

Perhaps this plant will be a viable proposition in the future if the need, technologies and the economics are certain. For the next ten years (or more) the emphasis in the electricity markets need to be rapid roll out of more renewables and resolution of the misalignment of ISO-NE’s market design with the state’s decarbonization goals.

The title of Ronald DeCurzio’s article should have been ‘Proposed Peabody gas plant, now on hold, makes no sense at this time’.

Works Cited

[1] MMWEC’s website says, “Capacity must be available to cover the MLP’s peak load, plus a reserve margin” https://www.project2015a.org/

[2] https://www.mass.gov/info-details/massachusetts-clean-energy-and-climate-plan-for-2030

[3] https://www.iso-ne.com/about/what-we-do/in-depth/solar-power-in-new-england-locations-and-impact

[4] BTM = Behind the Meter, i.e. distributed energy resources that ISO-NE cannot see and control

[5] https://commonwealthmagazine.org/opinion/proposed-peabody-gas-plant-now-on-hold-makes-sense/

[6] https://www.eversource.com/content/ema-c/business/save-money-energy/manage-energy-costs-usage/demand-response

[7] https://www.eversource.com/content/ema-c/residential/save-money-energy/manage-energy-costs-usage/demand-response/battery-storage-demand-response

[8] https://www.eversource.com/content/ema-c/residential/save-money-energy/explore-alternatives/electric-vehicles/ev-charger-demand-response

[9] https://www.powermag.com/mitsubishi-power-developing-100-ammonia-capable-gas-turbine/

[10] “Use of NH3 as a fuel in a CCGT power station is possible by cracking the NH3 into H2 and nitrogen before combusting the H2 in the gas turbine. Time to market for large scale application is estimated to be 5-10 years.” See the following reference

[11] https://www.topsectorenergie.nl/sites/default/files/uploads/Energie%20en%20Industrie/Power%20to%20Ammonia%202017.pdf

[12] https://tinyurl.com/enyecvxz

[13] https://power.mhi.com/special/hydrogen/article_1#para03

[15] Ibid. GTCC = Gas turbine combined cycle

[16] https://www.greentechmedia.com/articles/read/green-hydrogen-explained

[17] Remarks made at the New England Electricity Restructuring Roundtable, Boston, MA March 16, 2018

[18] https://www.vineyardwind.com/news-and-updates/2018/1/29/bombcyclone

[19] Richard Garvine & Willett Kempton, Accessing the wind field over the continental shelf as a resource for electric power, Journal of Marine Research, 66, 2008. https://www.researchgate.net/publication/233719706_Assessing_the_wind_field_over_the_continental_shelf_as_a_resource_for_electric_power

[20] Turbines require a minimum of 6.7 MPH to operate. Scientific papers use meters/sec, but such values have been converted to MPH in this paper. Winter averages are about 4:1 greater than those of summer.

[21] North American Electric Reliability Council, 2005

[22] https://www.iso-ne.com/static-assets/documents/2018/04/a2_operational_fuel_security_presentation_march_2018_rev1.pdf, Pg 23 & 24

[23] Increased renewables over the base case in the Jan. 17th draft. Subsequent to the Jan. 17th draft a new Business As Usual base case has been modeled that more realistically represents the current situation.

[24] https://www.iso-ne.com/static-assets/documents/2018/01/20180117_operational_fuel-security_analysis.pdf Page 15.

[25] https://www.mass.gov/info-details/massachusetts-clean-energy-and-climate-plan-for-2030 page 28

[26] https://brattlefiles.blob.core.windows.net/files/17233_achieving_80_percent_ghg_reduction_in_new_england_by_20150_september_2019.pdf

[27] https://tinyurl.com/enyecvxz

[28] http://nescoe.com/wp-content/uploads/2020/10/Electricity_System_Reform_GovStatement_14Oct2020.pdf

[29] https://www.utilitydive.com/news/new-england-states-push-iso-ne-governance-changes-mopr-caspr-reform/601342/