It’s been more than seven years since 196 countries came together to sign the Paris Agreement at the end of 2015, the most pivotal climate agreement in history. Since then, governments around the world have taken steps – some bolder than others – to slash greenhouse gas emissions and curb catastrophic climate change. Companies also joined in – with major corporations from Coca-Cola to United Airlines committing to reach net-zero emissions by 2050, which is the goal established in the Paris Agreement.

- Read the Banking on Climate Chaos report: bankingonclimatechaos.org

- Read the press release: World's Biggest Banks Continue to Pour Billions into Fossil Fuel Expansion

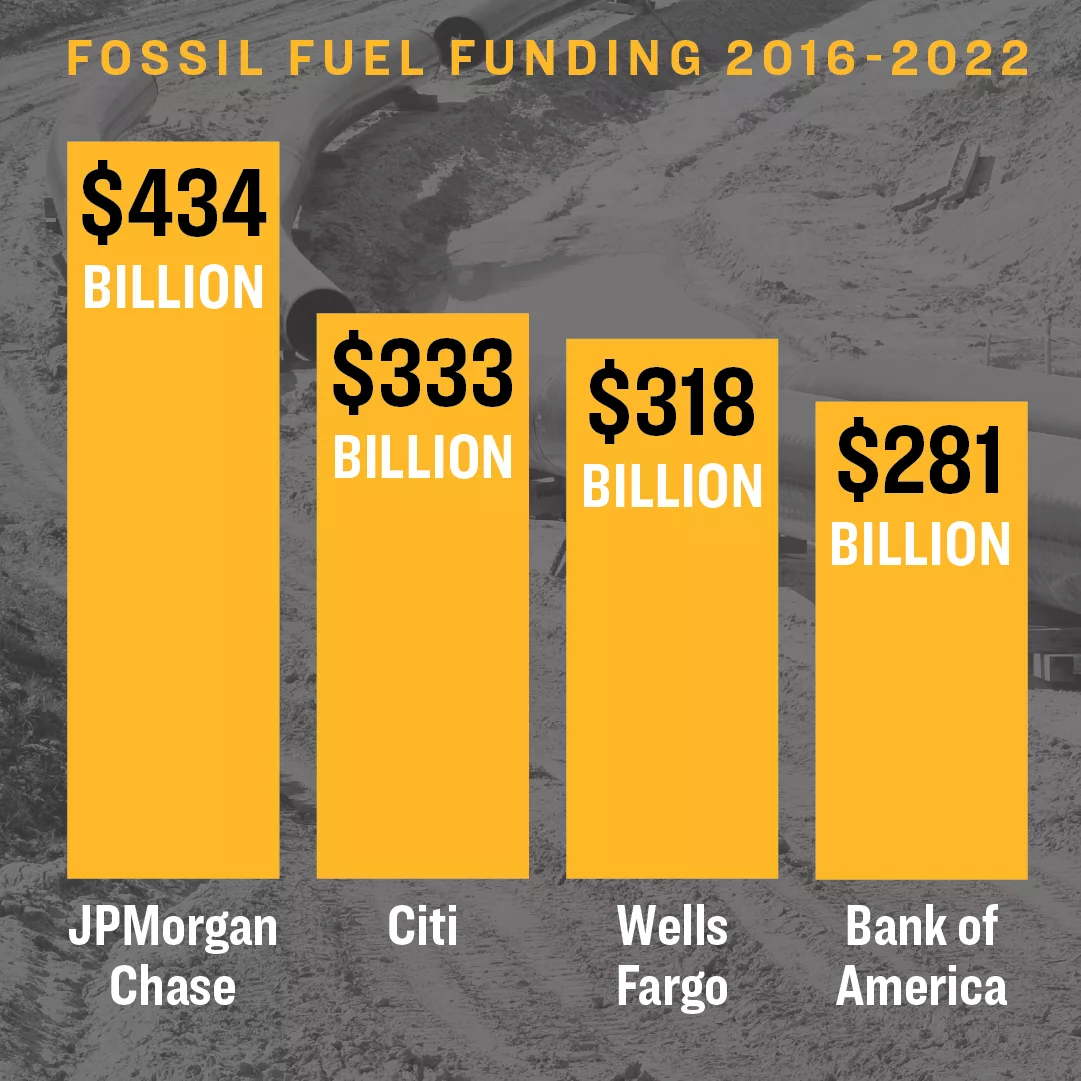

Banks, too, made these climate pledges. All six major US banks – JPMorgan Chase, Citi, Wells Fargo, Bank of America, Morgan Stanley, and Goldman Sachs – have committed to reach net-zero emissions by 2050. Unfortunately, in the years since the Paris Agreement was signed, big US banks have continued to increase their financing for fossil fuels, pouring billions into the companies expanding fossil fuel production every year.

Revealing the truth of banks' climate commitments by examining their financing of fossil fuels.

This year’s Banking on Climate Chaos report – the most comprehensive global analysis on fossil fuel funding – reveals the truth of banks’ climate commitments by examining their financing of the fossil fuel industry. It comes as no surprise that US banks top the list, accounting for 28% of all fossil fuel financing in 2022.

JPMorgan Chase remains the world’s worst funder of climate chaos since the Paris Agreement. Typically holding down the #1 spot annually, JPMorgan Chase fell from worst to second worst in 2022, beat out for the first time by the Royal Bank of Canada as the biggest fossil fuel financier of 2022. Citi, Wells Fargo, and Bank of America are still among the top 5 fossil financiers since 2016.

- Read the report: bankingonclimatechaos.org

And it’s not just US majors. In the seven years since the Paris Agreement, the world’s 60 largest private banks financed fossil fuels with a whopping $5.5 trillion. The report makes the shocking revelation that despite the fossil fuel industry’s record profits in 2022, big banks still poured $673 billion into the industry last year. Remarkably, this happened while oil majors like Exxon Mobil and Shell asked for $0 in financing from these banks in 2022.

One industry in particular saw a massive increase in bank financing: Liquified Natural Gas (LNG).

In 2022, financing for the top 30 companies in the methane gas (LNG) sector increased by nearly 50%. Among the top bankers of LNG last year were US majors Morgan Stanley, JPMorgan Chase, and Cti. Together with Japanese majors Mizuho and SMBC Group, and Dutch bank ING, these six banks increased their financing for top LNG companies by 60%, totaling $8.8 billion in 2022 alone.

These numbers tell a grim story of how big banks have fallen for the fossil industry’s cynical campaign to use the current energy crisis to justify their dangerous and reckless buildout of gas exports. But the truth is, building new gas export facilities (and the fracking rigs, pipelines, and other infrastructure that come with them) would lock in decades of fossil fuel production at a time when we need to halt expansion immediately.

Studies prove that fracked gas is as bad for the climate as oil and coal. In addition to the severe climate impacts, these LNG export facilities would exacerbate the pollution and associated public health impacts of communities already overburdened by the fossil fuel industry. Banks that are serious about meeting their climate commitments and protecting frontline communities must commit to phase out financing for LNG.

Banks claim to be committed to reducing their financed emissions and driving the clean energy transition. In reality, they are mostly continuing with business as usual.

Banks like to argue that they need to preserve relationships with their major energy clients in order to support the clean energy transition. This is true: if we are going to meet our climate goals, we need major banks to make massive investments in clean energy and energy efficiency.

However, by some calculations, just 7% of energy financing from global banks went to renewable energy between 2016 and 2022. Meanwhile, major energy companies are dropping their sustainability pretenses: Shell announced it will not increase spending on renewable energy, and Exxon walked away from its longstanding biofuel project. Oil majors aren’t even bothering to stick to their meager climate commitments – earlier this year, BP rolled back its own pledge to slash greenhouse gas emissions.

The fact is, banks aren’t financing the energy transition like they claim to be, and their biggest energy clients aren’t even pretending to try.

This year, shareholders are ramping up the pressure on banks to deliver on climate.

When banks say they can’t restrict financing for major energy companies because it would stop them from financing the green transition, the argument falls flat. Thankfully, bank customers and shareholders are waking up to that fact.

At this year’s annual meetings of major US banks, several shareholder proposals aim to address these concerns by calling on the banks to phase out financing for companies expanding fossil fuels, publish public transition plans, and improve their emissions reduction targets.

It’s incumbent on the biggest shareholders – from major asset managers to public pension funds – to hold these US banks accountable, and push them to finally deliver on their climate commitments. As the annual meetings begin in late April and run into mid May, climate-concerned investors will be watching to see how these big US banks plan to reconcile their climate commitments with their continued support for fossil fuel expansion.