This blog post is written by Kellie Ferguson, a resident of Giles County, Virginia, and a community organizer with the Protect Our Water, Rights, Heritage (POWHR) Coalition. Her community is directly impacted by the Mountain Valley Pipeline.

As a single mom of four, I work hard every day to teach my kids to be kind, healthy, independent, and happy. I know that outside our home they will be exposed to the grave injustices of a capitalist, extractive society. The best I can do is give them a loving foundation to stem from.

The horrors of extractive systems are now more apparent than ever for my family. Outside our windows in rural Appalachia, a reckless, greedy pipeline company is destroying our home to build a 303-mile fracked gas pipeline during a climate crisis. Every day I feel grief, rage, and dread for the future.

The sacred land I raised my children in is being polluted and torn apart by the Mountain Valley Pipeline. The corporations propping up this project aren’t just the big banks you might think of like Bank of America and Wells Fargo. Asset managers, institutions that manage the investments and retirement savings of pensions, corporations, and everyday Americans, play a big role in bringing this disaster to my doorstep.

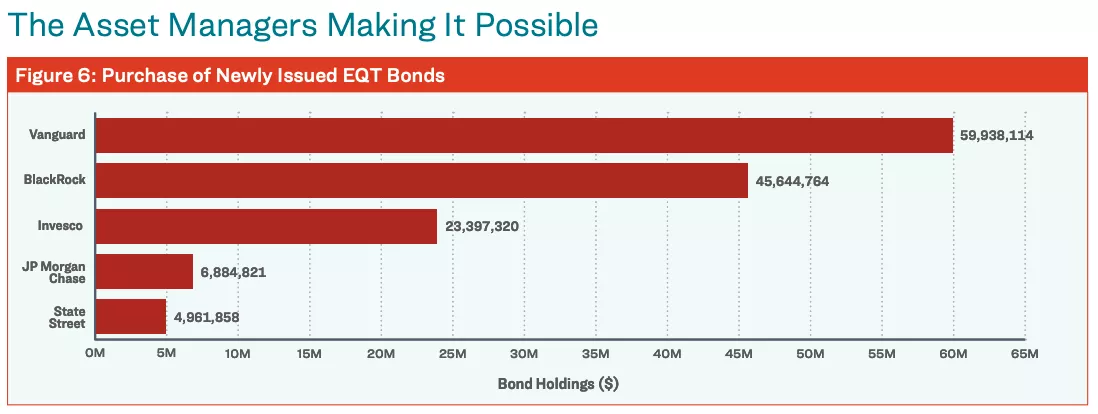

Some of the biggest investors in the Mountain Valley Pipeline are Vanguard, Black Rock, JP Morgan, State Street, and Invesco. These asset managers are putting peoples’ investments and retirement savings at risk by using our money to back beleaguered projects like the Mountain Valley Pipeline, which is nearly $5 billion dollars over budget and six years delayed. In less than 2 years, these 5 investors poured over $140 million into EQT, a major client of the Mountain Valley Pipeline, helping to funnel money to the Mountain Valley Pipeline's development.

These companies are robbing my kids’ of a future while they risk their investors' money on unnecessary fossil fuel projects.These projects are bad climate decisions and dangerous investments at risk of becoming stranded assets. By helping to build an energy future that is still entrenched in fossil fuels, these investments not only make things worse for the planet, but also build an unstable financial environment more likely to threaten our savings.

I am fighting for my kids’ future and I won’t let these companies’ complicity go unnoticed. Asset managers must wake up and make better financial decisions for their investors and for future generations.

To stop climate destruction, we need to stop financing projects like the Mountain Valley Pipeline. Join me in calling on the CEOs of Wall Street’s biggest asset managers to stop investing in fossil fuel expansion.

--

To read more about how asset managers fund fossil fuel expansion, check out this report.

To learn more about major asset manager Vanguard's role in financing the Mountain Valley Pipeline and what you can do about it, join this March 11 webinar.